Executive Summary: Navigating the High-Stakes Insurance Market in Late 2025

The construction sector is currently navigating one of the most volatile insurance markets in recent history. As we move deeper into Q4 2025, high-risk construction firms specifically those involved in roofing, heavy infrastructure, demolition, and multi-story commercial projects are facing a “hard market” characterized by tightening underwriting guidelines and premium fluctuations.

- Executive Summary: Navigating the High-Stakes Insurance Market in Late 2025

- Live Market Update: Today’s Construction Insurance Trends (November 2025)

- 1. The Surge in Medical Inflation and Workers’ Comp Costs

- 2. Tightening Capacity in the Excess & Surplus (E&S) Market

- 3. The Rise of “Nuclear Verdicts” and Liability Limits

- Top 10 High-Risk Business Insurance Companies for Construction Firms

- 1. AXA XL

- 2. The Travelers Companies, Inc.

- 3. AIG / Lexington Insurance Company

- 4. Liberty Mutual

- 5. Zurich North America

- 6. Chubb

- 7. CNA

- 8. Berkshire Hathaway Specialty Insurance (BHSI)

- 9. Nationwide (E&S / Scottsdale)

- 10. Starr Insurance Companies

- Deep Dive: Essential High-Risk Coverages for 2025

- Commercial General Liability (CGL) in a Litigious Era

- Excess and Umbrella Liability: The “Sleep at Night” Coverage

- Builders Risk Insurance: Protecting the Asset

- Workers Compensation for High-Hazard Trades

- Inland Marine: Tools & Equipment Coverage

- Understanding Insurance Costs: 2025 Price Breakdown

- Strategic Risk Management: How to Lower Your CPC (Cost Per Coverage)

- The Role of Specialized Brokers vs. Direct Writers

- Conclusion: Securing Your Future in a Hard Market

- Sources & Further Reading

For contractors and construction business owners, securing robust commercial general liability (CGL) and excess liability coverage is no longer just a compliance box to check; it is a critical asset protection strategy. This comprehensive guide provides a deep dive into the top 10 insurance carriers currently dominating the high-risk landscape, offering the specialized excess and surplus (E&S) lines necessary to cover complex exposures.

We will explore real-time market data, including the impact of rising medical inflation on workers’ compensation claims as of November 2025, and provide actionable intelligence on securing the best builders risk insurance quotes in a competitive environment.

Live Market Update: Today’s Construction Insurance Trends (November 2025)

Before diving into our carrier rankings, it is crucial to understand the immediate factors influencing your insurance premiums today.

1. The Surge in Medical Inflation and Workers’ Comp Costs

As of late November 2025, a primary driver of rising costs for construction firms is medical inflation. Recent industry reports indicate that the average medical cost per workers’ compensation claim has risen significantly year-over-year. This trend is putting immense pressure on premiums, particularly for high-risk trades where injury probability is statistically higher.

- Actionable Insight: Contractors must leverage telematics and AI-driven safety monitoring to negotiate better rates. Carriers are increasingly offering discounts for firms that can demonstrate proactive risk management.

2. Tightening Capacity in the Excess & Surplus (E&S) Market

Standard carriers are retreating from high-hazard risks, pushing more construction firms into the E&S market. This sector, which handles non-standard risks, is seeing an influx of demand.

- Live Data Point: Capacity for “frame and joisted masonry” construction projects is tightening, with minimum premiums for builders risk policies starting higher than in previous quarters. However, capacity for non-combustible construction remains stable.

3. The Rise of “Nuclear Verdicts” and Liability Limits

Social inflation—the rising costs of insurance claims resulting from increased litigation and larger jury awards—continues to be a trending concern. “Nuclear verdicts” (jury awards exceeding $10 million) are forcing contractors to seek higher umbrella insurance limits, often requiring layered programs involving multiple carriers to reach desired coverage levels of $5M, $10M, or more.

Top 10 High-Risk Business Insurance Companies for Construction Firms

The following list represents the elite tier of insurance carriers and wholesale brokers capable of handling the complex, high-liability needs of modern construction firms. These rankings reflect financial strength, claims handling expertise, and appetite for high-hazard risks.

1. AXA XL

- Best For: Large-scale commercial contractors and infrastructure projects.

- Market Position: A global powerhouse in the construction insurance sector, AXA XL is renowned for its capacity to write massive risks that other carriers decline. Their dedicated construction vertical offers specialized pollution liability and professional liability designed for the unique exposures of design-build firms.

- Why They Win: AXA XL’s “Construction Ecosystem” integrates technology partners to help clients monitor job sites, potentially lowering general liability costs through proven risk reduction.

- Key Coverage: Contractors All Risk (CAR), Excess Casualty, and specialized Subcontractor Default Insurance (SDI).

2. The Travelers Companies, Inc.

- Best For: Mid-to-large sized general contractors requiring bundled coverage.

- Market Position: Travelers remains a dominant force with a massive market share in commercial construction insurance. Their “bundled” approach allows contractors to combine commercial auto, inland marine, and workers compensation into a streamlined program.

- Why They Win: Their risk control services are among the best in the industry. Travelers provides access to industrial hygiene labs and safety professionals who can visit job sites to assess hazards, a value-add that can stabilize insurance premiums over time.

- Key Coverage: Comprehensive Builders Risk, Inland Marine (for heavy equipment), and high-limit Umbrella policies.

3. AIG / Lexington Insurance Company

- Best For: Extremely high-risk, hard-to-place accounts and Excess & Surplus needs.

- Market Position: Lexington, an AIG company, is the leading U.S.-based surplus lines insurer. When a project is too risky for the standard market (e.g., demolition in a dense urban area), Lexington is often the go-to market.

- Why They Win: Flexibility. As an E&S carrier, they have the freedom to craft policy language that addresses unique project risks that admitted carriers cannot touch. This is critical for contractors liability insurance on non-standard projects.

- Key Coverage: Excess Casualty, Environmental Liability, and severe-weather exposed Builders Risk.

4. Liberty Mutual

- Best For: Heavy civil engineering and energy construction projects.

- Market Position: Liberty Mutual’s construction division is a top-tier choice for contractors building critical infrastructure (roads, bridges, energy plants). They have a deep appetite for heavy construction risks.

- Why They Win: Their claims management for workers compensation is highly sophisticated, utilizing data analytics to close claims faster and reduce the total cost of risk (TCOR) for policyholders.

- Key Coverage: Ironshore (their specialty brand) offers leading environmental liability and construction professional liability.

5. Zurich North America

- Best For: Global contractors and project-specific policies.

- Market Position: Zurich is a staple in the construction world, particularly for “Project Specific” policies where a single insurance program covers the owner, general contractor, and all subcontractors (Wrap-Ups/OCIPs/CCIPs).

- Why They Win: Financial stability and global reach. If you are a U.S. contractor taking on international work, or a foreign firm building in the U.S., Zurich’s global network is indispensable for maintaining consistent liability coverage.

- Key Coverage: Master Builders Risk, Contractor’s Protective Professional Indemnity, and Subcontractor Default Insurance.

6. Chubb

- Best For: Sophisticated commercial builders seeking premium policy terms.

- Market Position: Chubb is synonymous with high-end coverage. While they may not always be the cheapest option for a general liability quote, their policy forms are often broader, with fewer exclusions than competitors.

- Why They Win: Superior claims service. In high-stakes construction litigation, having a carrier that defends its insureds aggressively is worth the premium. Their inland marine insurance for protecting valuable construction machinery is top-rated.

- Key Coverage: Installation Floaters, high-limit Critical Catastrophe coverage, and broad-form Commercial General Liability.

7. CNA

- Best For: Specialized trades and electrical/mechanical contractors.

- Market Position: CNA has a long history of serving the construction industry, with specific programs tailored for trade contractors (HVAC, electrical, plumbing) who face unique professional liability and installation risks.

- Why They Win: Their “Pay-As-You-Go” workers compensation solutions and deep understanding of trade-specific risks make them a favorite for mid-sized subcontractors.

- Key Coverage: Contractors Errors & Omissions (E&O), Equipment Breakdown, and Commercial Auto for fleets.

8. Berkshire Hathaway Specialty Insurance (BHSI)

- Best For: Large excess towers and catastrophic risk capacity.

- Market Position: Backed by the immense capital of Berkshire Hathaway, BHSI is a major player in the excess market. When contractors need $25 million or $50 million in liability limits, BHSI is often part of the tower.

- Why They Win: Financial impregnability. In an era of carrier insolvencies and rating downgrades, BHSI’s “fortress balance sheet” provides peace of mind for long-tail construction risks like construction defect claims that may arise years after completion.

- Key Coverage: Excess Casualty, Construction Property, and Surety Bonds.

9. Nationwide (E&S / Scottsdale)

- Best For: Mid-market contractors with harder-to-place exposures.

- Market Position: Through their E&S arm (Scottsdale), Nationwide accepts risks that standard markets reject, such as roofers with open flame exposure or contractors working on track home developments (which have high construction defect litigation rates).

- Why They Win: Speed and distribution. Nationwide’s E&S platform is accessible to many wholesale brokers, making it easier for local agents to secure quotes for high-risk clients quickly.

- Key Coverage: Commercial General Liability for artisan contractors, Excess Liability, and completed operations coverage.

10. Starr Insurance Companies

- Best For: Environmental contractors and complex casualty.

- Market Position: Starr is a rapidly growing force in the construction casualty space. They are particularly aggressive in writing pollution liability insurance and casualty programs for infrastructure projects.

- Why They Win: Their flat management structure often allows for quicker underwriting decisions on complex accounts compared to larger, more bureaucratic carriers.

- Key Coverage: Construction Pollution, Primary and Excess Casualty, and Defense Base Act (DBA) coverage for overseas government contractors.

Deep Dive: Essential High-Risk Coverages for 2025

To truly protect a high-risk construction business, standard policies are insufficient. You must structure a portfolio of coverage that addresses the specific “pain points” of the 2025 legal and physical environment.

Commercial General Liability (CGL) in a Litigious Era

The cornerstone of any construction insurance program, CGL covers third-party bodily injury and property damage. However, for high-risk firms, the details of the policy are critical.

- Action items: Ensure your policy does not have a “Residential Exclusion” or “Subcontractor Warranty” that could void coverage if a sub fails to maintain their own insurance.

- Trending Term: “Action Over Exclusion.” Many cheaper policies include this exclusion, which removes coverage for lawsuits filed by injured employees of subcontractors. Avoid this exclusion at all costs.

Excess and Umbrella Liability: The “Sleep at Night” Coverage

With the average cost of a severe construction accident claim skyrocketing, a $1 million primary limit is rarely enough.

- Market Shift: In 2025, we are seeing contracts frequently require $5 million to $10 million in umbrella limits.

- Strategy: “Towering” limits by using multiple carriers (e.g., $2M from Carrier A, $3M excess of that from Carrier B) can sometimes be more cost-effective than buying a single massive policy.

Builders Risk Insurance: Protecting the Asset

Also known as “Course of Construction” insurance, this covers the structure itself while it is being built.

- High-Risk Focus: For projects in wildfire or hurricane zones, standard carriers may decline. You will likely need a “Difference in Conditions” (DIC) policy or a specific E&S placement to cover these catastrophic perils.

- Cost Driver: Wood frame construction projects are seeing the steepest rate increases due to fire risk.

Workers Compensation for High-Hazard Trades

Roofing, steel erection, and excavation have the highest “Class Codes” rates.

- 2025 Trend: “Ex-Mod” Management. Your Experience Modification Rate (EMR) is the single biggest factor in your premium. An EMR above 1.00 acts as a debit (surcharge).

- Solution: Partner with carriers offering aggressive “Return to Work” programs which help lower claim reserves and reduce your EMR faster.

Inland Marine: Tools & Equipment Coverage

Contractors often mistakenly believe their Business Personal Property (BPP) policy covers their excavators and generators at the job site. It usually does not.

- Requirement: You need an Inland Marine floater to cover equipment that moves from site to site.

- Theft Wave: With equipment theft rising in 2025, ensure your policy covers “Replacement Cost” rather than “Actual Cash Value,” so you aren’t left out of pocket for depreciation on stolen gear.

Understanding Insurance Costs: 2025 Price Breakdown

While every business is unique, current market data gives us a baseline for what high-risk contractors should expect to budget.

| Insurance Type | Average Annual Premium (Small-Mid High Risk Firm) | Key Cost Driver |

| General Liability | $3,000 – $15,000+ | Revenue & Operations Type (e.g., Roofing vs. Carpentry) |

| Workers Comp | $20,000 – $100,000+ | Payroll size & Class Codes (Risk level of tasks) |

| Builders Risk | 1% – 4% of Project Value | Construction Type (Frame vs. Concrete) & Location |

| Commercial Auto | $2,000 – $4,000 per vehicle | Driver Records (MVRs) & Vehicle Weight |

| Umbrella ($1M) | $1,500 – $3,500 | Underlying limits & Claims History |

Note: These figures are estimates based on Q3/Q4 2025 market aggregation. High-risk trades in litigious states like New York or California will see significantly higher premiums.

Strategic Risk Management: How to Lower Your CPC (Cost Per Coverage)

Reducing your insurance spend without sacrificing coverage requires a proactive approach. Underwriters in 2025 are looking for “best-in-class” operations.

1. Subcontractor Management Protocols

Liability often flows upstream. If your subcontractor causes an accident and has no insurance, you are liable.

- Best Practice: Implement an automated Certificate of Insurance (COI) tracking system.

- Requirement: Mandate that all subcontractors name your firm as an “Additional Insured” on a primary and non-contributory basis.

2. Technology Integration

Carriers like AXA XL and Travelers are offering premium credits for tech adoption.

- Wearables: Devices that track employee lifting techniques to prevent back injuries.

- IoT Sensors: Water leak detectors in high-rise construction to prevent massive water damage claims during the build.

3. Contractual Risk Transfer

Your client contracts are your first line of defense. Ensure your “Indemnification” clauses are reviewed by a construction attorney to ensure they are enforceable in your state. Passing liability to the responsible party is the most effective way to protect your loss history.

The Role of Specialized Brokers vs. Direct Writers

For high-risk construction, the “Direct to Consumer” (online quote) model often fails.

- The Broker Advantage: You need a “Retail Broker” who has access to “Wholesale Brokers” (like Amwins, CRC, or RT Specialty). These wholesalers are the gatekeepers to the E&S markets (AIG, Scottsdale, etc.).

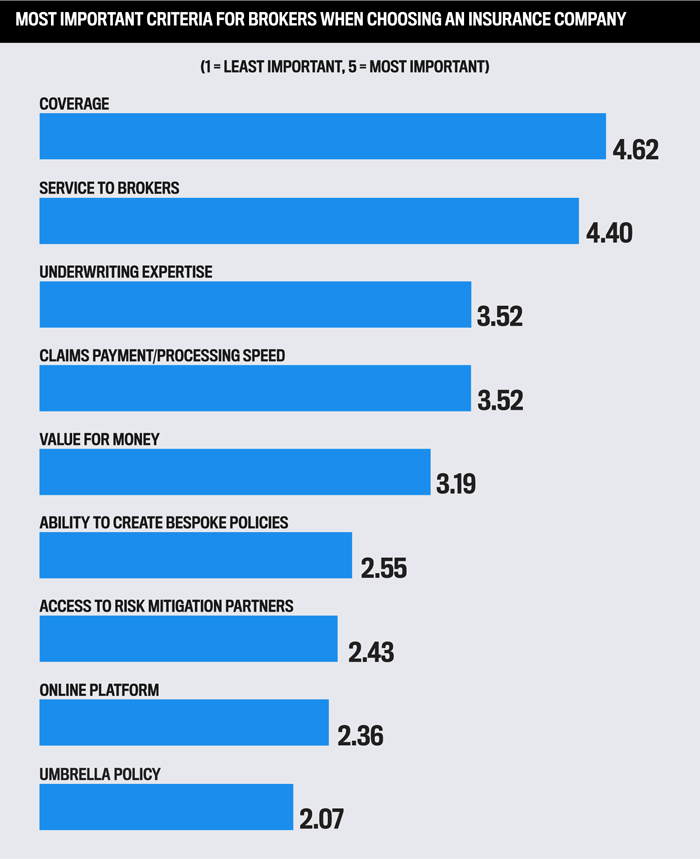

- Selection Criteria: Ask your broker, “How much construction premium do you place annually?” If they are a generalist, they likely lack the leverage to negotiate with the tough high-risk underwriters.

Conclusion: Securing Your Future in a Hard Market

The landscape for high-risk business insurance in 2025 is defined by selectivity. Carriers are willing to deploy capital, but only for contractors who treat risk management as a core business function.

By aligning with top-tier carriers like Chubb, Travelers, or AXA XL, and utilizing the specialized capacity of the Excess & Surplus market, construction firms can build a shield against the financial threats of modern litigation and physical perils.

Do not wait for your renewal date. Start the conversation with your broker 90 to 120 days in advance. The complexity of the 2025 market demands time to market your account to multiple carriers to secure the most competitive liability insurance quotes.

Sources & Further Reading

- Construction Coverage – Best Builders Risk Insurance 2025: Detailed reviews of carrier financial strength and policy forms.

- IRMI (International Risk Management Institute): “20 Workers Comp Issues to Watch in 2025” – Analysis of medical inflation and regulatory changes.

- AM Best Credit Ratings: Real-time financial strength ratings for all listed carriers.

- NCCI (National Council on Compensation Insurance): Data on workers compensation rate trends and class code updates.

- Program Business: “Top Trending Insurance Markets October 2025” – Insights into capacity constraints in the builders risk sector.