The decision to form a Limited Liability Company (LLC) is rarely just about paperwork; it is a foundational financial strategy. For sophisticated entrepreneurs, high-net-worth individuals, and real estate investors, the choice of jurisdiction specifically between Delaware and Nevada dictates the future of asset protection, tax liability, and operational flexibility. As we navigate the fiscal landscape of 2025, the “Delaware vs. Nevada” debate has evolved beyond simple filing fees into a complex analysis of judicial precedence, privacy architecture, and tax nexus nuances.

- The Strategic Landscape: Jurisdiction as an Asset Class

- Delaware LLCs: The Gold Standard for Capital

- 1. The Court of Chancery: Reducing Commercial Risk

- 2. The 2025 Delaware Tax Structure

- 3. The “Series LLC” Advantage

- 4. Privacy Protocols

- Nevada LLCs: The Fortress of Solitude

- 1. The Charging Order: Sole Remedy Protection

- 2. The “No Tax” Environment

- 3. The Commerce Tax and 2025 Thresholds

- 4. The “Hidden” Costs of Nevada

- Direct Comparison: The 2025 Tax Showdown

- The Corporate Transparency Act (CTA): 2025 Updates

- Investment Considerations: Venture Capital and Real Estate

- Maintenance and Compliance: The “Good Standing” Trap

- The “Nexus” Trap: Where Do You Actually Pay Tax?

- Conclusion: Making the 2025 Decision

This comprehensive guide dissects the strategic advantages of both jurisdictions. We will move beyond the surface-level comparisons to explore the deep mechanics of charging orders, the 2025 status of the Corporate Transparency Act, and the reality of “tax-free” states. Whether you are structuring a holding company for intellectual property or preparing a tech startup for Series A funding, understanding these distinctions is critical to your fiscal solvency.

The Strategic Landscape: Jurisdiction as an Asset Class

When you file Articles of Organization, you are essentially purchasing a product the legal system and tax code of a specific state. In 2025, the market for corporate domicile is competitive. Delaware markets its Chancery Court and commercial predictability, while Nevada markets privacy and aggressive asset protection.

Choosing the wrong jurisdiction can lead to unnecessary “foreign qualification” fees, double taxation, or a pierced corporate veil during litigation. Conversely, the right choice can streamline capital acquisition and create a formidable barrier against creditors.

The “Home State” Rule

Before diving into the Delaware and Nevada nuances, we must address the concept of “doing business.” If your business is a coffee shop in Austin, Texas, forming a Nevada LLC generally adds complexity without benefit. You will still owe Texas franchise taxes and must register the Nevada LLC as a foreign entity in Texas.

However, for location-independent businesses, digital nomads, holding companies, and e-commerce ventures, the choice of domicile is a primary lever for tax optimization.

Delaware LLCs: The Gold Standard for Capital

Delaware is not just a state; it is a brand. Over 66% of Fortune 500 companies are incorporated here. For the LLC owner in 2025, Delaware offers a specific set of tools designed principally for scalability and investment.

1. The Court of Chancery: Reducing Commercial Risk

The primary “product” Delaware sells is its legal system. Unlike other states where business disputes are heard by juries who may not understand complex fiduciary duties, Delaware disputes are heard by the Court of Chancery. This is a court of equity, presided over by judges (Chancellors) who are experts in corporate law.

For an LLC owner, this translates to predictability. If a minority member sues for breach of contract, the outcome in Delaware is based on decades of established case law. In 2025, with litigation costs rising, this predictability acts as a form of insurance. Investors prefer Delaware because they know exactly how the contract will be interpreted.

2. The 2025 Delaware Tax Structure

There is a persistent myth that Delaware is a tax haven. This is only partially true. Delaware is a “tax haven” for passive income generated outside the state, but it enforces strict compliance fees.

- The Franchise Tax (LLC): For 2025, the Delaware LLC franchise tax remains a flat rate of $300 per year. This is due on or before June 1st. It is important to note that unlike corporations, which calculate tax based on authorized shares, the LLC fee is static. This predictability is vital for forecasting holding costs.

- State Income Tax: If your LLC does not conduct business within Delaware (no physical office, no employees in the state), it pays 0% state corporate income tax. This makes it an ideal vehicle for holding intangible assets like trademarks or patents.

- Gross Receipts Tax: If you have no operations in Delaware, you are exempt.

3. The “Series LLC” Advantage

Delaware pioneered the Series LLC, a structure that allows a single parent LLC to hold unlimited “cells” or series. Each series has its own assets, members, and liability shield.

2025 Application: Real estate investors are increasingly using Delaware Series LLCs to hold multiple properties. Property A is held in Series 1, and Property B is held in Series 2. A lawsuit against Property A generally cannot reach the assets of Property B. This consolidation saves thousands in filing fees compared to forming separate LLCs for every asset.

4. Privacy Protocols

Delaware offers a moderate layer of privacy. The Certificate of Formation requires the name of the Registered Agent, not the members or managers. However, Delaware does not view privacy as absolute. In the event of a lawsuit, the “corporate veil” can be pierced if the court finds the entity was used for fraud. The state prioritizes corporate governance over secrecy.

Nevada LLCs: The Fortress of Solitude

If Delaware is built for the boardroom, Nevada is built for the vault. Nevada has aggressively legislated to become the premier jurisdiction for asset protection and privacy. For business owners concerned about frivolous litigation or aggressive creditors, Nevada offers protections that Delaware does not.

1. The Charging Order: Sole Remedy Protection

This is the crown jewel of Nevada’s LLC statute. In many states, if a personal creditor wins a judgment against you (the individual), they can foreclose on your LLC ownership, seize the voting rights, and liquidate the company assets to pay your personal debt.

Nevada law restricts this. The Charging Order is the “sole remedy” for personal creditors. A creditor with a charging order only has the right to receive distributions if they are made. They cannot vote, they cannot force a sale, and they cannot seize the company assets.

2025 Nuance: Nevada courts have consistently upheld this protection even for single-member LLCs. In many other jurisdictions, single-member LLCs are seen as “disregarded entities” for liability purposes, allowing creditors to pierce the veil easily. Nevada statutory law explicitly protects single-member entities.

2. The “No Tax” Environment

Nevada’s tax appeal is straightforward.

- Corporate Income Tax: 0%

- Personal Income Tax: 0%

- Franchise Tax: $0

However, “no tax” does not mean “no cost.” To replace income tax revenue, Nevada relies on aggressive fee structures and the Commerce Tax.

3. The Commerce Tax and 2025 Thresholds

The Nevada Commerce Tax is a gross receipts tax imposed on businesses with a Nevada gross revenue exceeding $4,000,000 during the taxable year.

- Rate: Varies by industry (0.051% to 0.331%).

- Implication: For most small to mid-sized LLCs, you will file a return but pay zero tax because you fall under the $4M threshold. However, the compliance burden exists. You must file the return to prove you do not owe the tax.

4. The “Hidden” Costs of Nevada

While Delaware has a $300 flat tax, Nevada’s fee structure is more fragmented.

- Initial Filing: $425 minimum (includes the initial list of managers and business license).

- Annual List of Officers: $150 (due annually).

- State Business License: $200 (due annually).

- Total Annual Maintenance: Approximately $350 per year.

While comparable to Delaware’s $300, Nevada’s fees tend to increase if the authorized capital/shares structure changes (for corporations), though LLCs largely stay flat. The real cost in Nevada comes from the strict requirement to maintain a Registered Agent within the state to avoid penalties.

Direct Comparison: The 2025 Tax Showdown

To make an informed decision, we must look at the numbers side by side. This comparison assumes a standard LLC structure with no physical operations in either state (a “foreign” entity scenario).

| Category | Delaware LLC | Nevada LLC |

| State Income Tax | 0% (for non-residents) | 0% |

| Franchise/License Tax | $300 Flat Fee | ~$350 (List + License Fee) |

| Gross Receipts Tax | None (for non-residents) | Commerce Tax (only if >$4M revenue) |

| Anonymity | Managers not listed on formation docs. | Annual List of Managers is public. |

| Asset Protection | Strong (Charging order is remedy). | Strongest (Charging order is sole remedy). |

| Listing Requirements | No annual report for LLCs. | Annual List required. |

| IRS Information Sharing | Yes. | No (Nevada does not share with IRS). |

| Commercial Court | Court of Chancery (Judges). | Business Courts (improving, but less established). |

The “Sleeve” Strategy

Advanced tax strategists in 2025 often use a hybrid approach. For example, a Wyoming LLC might serve as the holding company (due to low fees and privacy), which then owns a Nevada LLC for operational risk, or a Delaware C-Corp for raising capital. This “sleeve” strategy isolates liabilities while optimizing for the specific benefit of each jurisdiction.

The Corporate Transparency Act (CTA): 2025 Updates

The regulatory environment in 2025 is dominated by the Corporate Transparency Act. This federal law mandated that most LLCs report their “Beneficial Owners” (individuals who own 25% or more or exercise substantial control) to FinCEN.

Critical 2025 Update:

As of March 2025, significant legal challenges have altered the enforcement landscape. Following court rulings (specifically regarding National Small Business United v. Yellen and subsequent interim rules), the mandatory reporting requirement for many domestic US entities has been effectively paused or exempted for broad categories of existing small businesses.

- What this means for you: If you are forming a new LLC in late 2025, you must verify the current status of this exemption with a legal professional. While the initial aggression of the CTA has been curbed by the courts, voluntary compliance or specific state-level transparency acts (like New York’s LLC Transparency Act) may still apply.

- Delaware vs. Nevada Impact: Neither state can override federal law. However, Nevada’s internal state privacy remains superior. Even if you must disclose ownership to FinCEN (a federal database not open to the public), Nevada does not publish your name on the Secretary of State website if you utilize nominee managers properly. Delaware also maintains a high degree of privacy from the general public.

Investment Considerations: Venture Capital and Real Estate

Your industry dictates your choice. The requirements of a tech founder are vastly different from those of a rental property owner.

For Tech Startups and VC Funding

If your goal is to raise money from Angel Investors or Venture Capitalists, Delaware is the only wrong choice.

- The “Check-Box” Effect: VCs operate on standardized legal documents (like the NVCA model documents). These docs are written for Delaware law. If you approach a VC with a Nevada LLC, they will likely force you to convert it to a Delaware C-Corp before writing a check. This conversion costs time and legal fees ($2,000 to $5,000).

- Stock Incentives: Delaware has the most robust framework for issuing stock options and equity grants to employees. The predictability of how these options vest and are taxed in the event of a merger is unparalleled.

For Real Estate and High-Risk Assets

If you are holding rental properties, heavy machinery, or operating in a litigious industry (like construction or medical consulting), Nevada (or Wyoming) is often superior.

- The Veil: In real estate, the goal is to prevent a slip-and-fall lawsuit at Property A from taking your personal house. Nevada’s strict “piercing the corporate veil” standards make it incredibly difficult for a plaintiff to reach your personal assets. They must prove “fraud or injustice,” a very high legal bar.

- Privacy: Real estate owners often wish to hide their net worth from tenants and predatory lawyers. Nevada’s nominee service capabilities allow you to keep your name off public records entirely.

Maintenance and Compliance: The “Good Standing” Trap

A common failure mode for LLC owners is losing “Good Standing” status. In 2025, automated compliance systems are stricter than ever.

Delaware Compliance

- Due Date: Franchise Tax is due June 1.

- Penalty: $200 penalty plus 1.5% interest per month.

- Registered Agent: You must maintain a Delaware Registered Agent (cost: $50 to $200/year). If this lapses, the state administratively dissolves your LLC.

- Restoration: reviving a dead Delaware LLC can be expensive, often requiring payment of all back taxes plus penalties.

Nevada Compliance

- Due Date: End of the month of your anniversary of formation. (e.g., if formed Nov 15, due Nov 30).

- Penalty: High. Nevada charges hefty late fees for both the Annual List and the Business License.

- Commercial Domicile: Nevada is aggressive about “commercial domicile.” If you claim to be a Nevada business but operate entirely in California, California franchise tax board may aggressively pursue you. Nevada, however, will happily collect your fees regardless of where you operate.

The “Nexus” Trap: Where Do You Actually Pay Tax?

This is the most misunderstood concept in LLC structuring. Forming an LLC in Nevada does not automatically exempt you from taxes in your home state.

Scenario: You live in California. You form a Nevada LLC for your consulting business. You work from your laptop in Los Angeles.

- Result: You are “doing business” in California. You must register the Nevada LLC as a foreign entity in California (paying the $800 CA tax). You must also pay the Nevada fees ($350). You have effectively doubled your compliance costs without saving a dime in taxes.

The Solution: The Nevada/Delaware advantage is optimized for income that is not sourced to a specific location, such as:

- Capital Gains: Trading stocks or crypto.

- Intellectual Property Royalties: Licensing software or brands.

- Passive Real Estate: Holding properties in non-income-tax states.

If you are an active service provider, the “tax savings” of Nevada are often an illusion unless you physically move yourself to Nevada.

Conclusion: Making the 2025 Decision

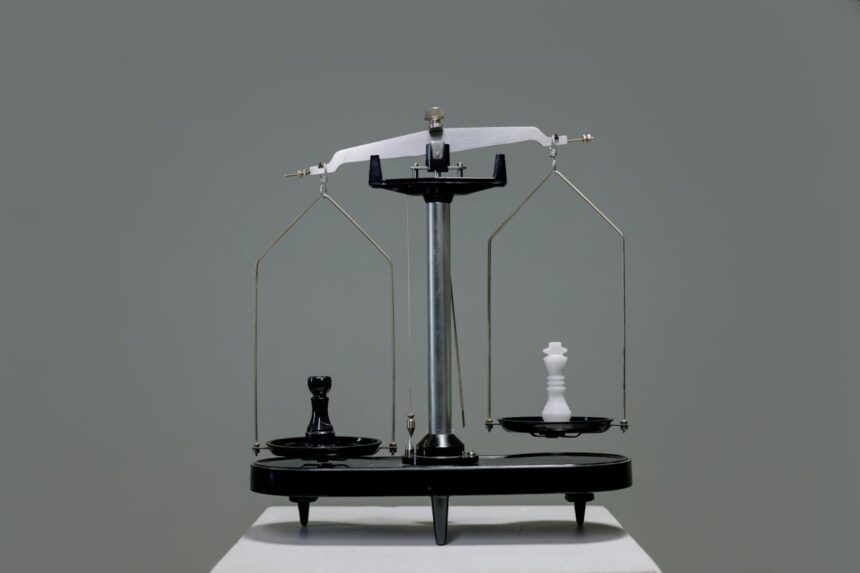

The choice between Delaware and Nevada is a choice between commercial utility and defensive fortification.

Choose Delaware If:

- You plan to raise Venture Capital or seek institutional funding.

- You anticipate an eventual IPO.

- You require a complex equity structure with multiple classes of shares.

- You want the highest level of legal predictability in commercial disputes.

Choose Nevada If:

- You are a high-net-worth individual seeking privacy.

- You are investing in assets with high liability risk (real estate, fleets).

- You want the strongest statutory protection against personal creditors (Charging Orders).

- You are operating a business with revenue over $4M and want to optimize gross receipts taxation nuances (consult a CPA).

In the fiscal environment of 2025, the cost of formation is negligible compared to the cost of a legal error. The $300 or $350 annual fee is a small premium to pay for the shield these jurisdictions provide. However, that shield is only as strong as your maintenance of it. Ensure your Operating Agreement is customized, your corporate minutes are maintained, and your Registered Agent is paid.

Actionable Next Step

For business owners ready to proceed, the immediate next step is to conduct a Nexus Audit. Before filing in Delaware or Nevada, determine where your “economic presence” legally exists. Would you like me to help you outline a checklist for a Nexus Audit to determine if a foreign qualification will be required for your specific business model?