Securing capital remains the most critical hurdle for small business owners in the fiscal landscape of 2025. With fluctuating interest rates and tightening lending standards among traditional banking institutions, the Small Business Administration (SBA) 7(a) loan program stands as the premier financing vehicle for entrepreneurs. It offers reasonable terms, capped interest rates, and the versatility required for scaling operations, purchasing real estate, or refinancing existing high-interest debt.

- What is the SBA 7(a) Loan Program?

- Core Eligibility Requirements for 2025

- The 5 Cs of Credit: What Lenders Analyze

- Detailed Documentation Checklist

- Interest Rates and Fees in 2025

- Strategies to Get Approved Fast

- 1. Choose a PLP Lender

- 2. Utilize SBA Express

- 3. Pre-Flight Your Financials

- 4. Address Life Insurance Early

- Common Reasons for Rejection (and How to Avoid Them)

- Alternatives to SBA 7(a) Loans

- The Role of Fintech in 2025 Lending

- Conclusion: Taking the Next Step

- Frequently Asked Questions (FAQ)

Understanding the nuance of the SBA 7(a) loan requirements is not merely about compliance. It is about strategic preparation. Lenders in 2025 are utilizing advanced underwriting algorithms and stricter risk assessment models. To navigate this, borrowers must present a faultless application package.

This guide serves as your comprehensive manual for navigating the SBA 7(a) process. We will dissect the eligibility criteria, analyze the documentation needed for rapid underwriting, and explore the financial ratios that credit committees are prioritizing this year.

What is the SBA 7(a) Loan Program?

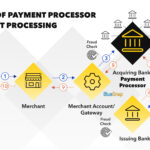

The SBA 7(a) loan is the agency’s primary program for providing financial assistance to small businesses. It is important to clarify a common misconception: the SBA does not lend the money directly. Instead, the agency guarantees a portion of the loan provided by an approved lender, such as a bank or credit union. This guarantee, which can cover up to 85% of the loan amount depending on the total sum, reduces the risk for lenders and incentivizes them to approve capital for small businesses that might not qualify for conventional financing.

In 2025, the maximum loan amount for a standard 7(a) loan remains at $5 million. These funds are incredibly flexible and can be utilized for various business purposes.

Permitted Use of Proceeds

- Working Capital: Covering operational expenses, payroll, and inventory purchases.

- Business Acquisition: Buying an existing business or executing a partner buyout.

- Real Estate: Purchasing land or buildings, including new construction or renovation of existing facilities.

- Equipment: Purchasing machinery, furniture, fixtures, or supplies.

- Refinancing: Paying off existing business debt under specific conditions where the new terms are substantially more beneficial to the borrower.

Core Eligibility Requirements for 2025

Before gathering tax returns or financial statements, you must ensure your business meets the foundational eligibility criteria set by the SBA. While individual lenders may overlay their own stricter requirements, the SBA mandates the following baselines.

1. Business Status and Location

Your entity must be a for-profit business officially registered and operating in the United States or its territories. Non-profit organizations are ineligible for the 7(a) program. Additionally, the business owner must have invested their own time or money into the business, demonstrating “skin in the game.”

2. Size Standards

The SBA defines “small” differently depending on the industry. This is typically based on either the average annual receipts or the average number of employees.

- Manufacturing: Generally up to 500 to 1,500 employees.

- Wholesaling: Up to 100 employees.

- Services: Average annual receipts ranging from $2.5 million to $21.5 million.

- Retail: Average annual receipts ranging from $7.5 million to $38.5 million.You must check the SBA Size Standards Tool to confirm your specific NAICS code qualifies.

3. “Credit Elsewhere” Test

A unique aspect of SBA lending is the “Credit Elsewhere” requirement. The lender must certify that the business cannot obtain the requested funds on reasonable terms from non-federal sources without the SBA guarantee. This protects the integrity of the private lending market while ensuring the SBA supports those who truly need the boost.

The 5 Cs of Credit: What Lenders Analyze

When a loan officer reviews your file in 2025, they are looking at the “5 Cs of Credit.” Mastering these five areas is the secret to moving your application from the “pending” pile to the “approved” pile.

1. Character

Lenders assess the integrity and management ability of the borrower. This is subjective but backed by data. They look at your personal credit history, your experience in the industry, and your background. Any past bankruptcies or criminal records must be disclosed and explained with detailed letters of explanation.

2. Capacity (Cash Flow)

This is arguably the most significant factor. Capacity refers to your business’s ability to repay the loan. Lenders calculate the Debt Service Coverage Ratio (DSCR).

- The Magic Number: A DSCR of 1.15 to 1.25 is typically the minimum requirement. This means for every $1 of debt payment (principal and interest), your business must generate $1.15 to $1.25 in net operating income.

- Projections: For startups or businesses undergoing expansion, lenders will rely heavily on two years of financial projections to prove future capacity.

3. Capital

This refers to the business net worth and the equity injection the borrower puts into the deal. Lenders want to see that you have enough capital to weather a financial storm.

- Down Payments: For 2025, expect a requirement of at least 10% equity injection for startups or business acquisitions. For commercial real estate, this creates a significant advantage over conventional loans, which often require 20% to 30% down.

4. Collateral

While the SBA does not require loans to be fully collateralized, lenders are required to take all available assets as collateral up to the liquidation value of the loan.

- Business Assets: Machinery, equipment, accounts receivable, and inventory.

- Personal Assets: If business assets are insufficient, lenders may place a lien on personal real estate (your home). However, the SBA prohibits a lender from declining a loan solely because of a lack of collateral if the cash flow is strong.

5. Conditions

This refers to the purpose of the loan and the economic environment. Lenders will evaluate the health of your specific industry. For example, a loan for a tech consulting firm might be viewed differently than a loan for a niche retail store in a declining market. You must articulate how the loan proceeds will help you adapt to current market conditions.

Detailed Documentation Checklist

Speed in the SBA world comes from organization. The back-and-forth communication between borrowers and underwriters regarding missing documents is the number one cause of delays. Prepare the following comprehensive package before you even approach a lender.

Business Financials

- Profit and Loss (P&L) Statements: Current year-to-date P&L (dated within 90 days) and full-year P&L for the last three fiscal years.

- Balance Sheets: Corresponding to the P&L dates.

- Business Tax Returns: Full federal income tax returns for the previous three years, signed.

- Debt Schedule: A detailed list of all existing business debts, including creditor names, monthly payments, interest rates, original balances, and current balances.

Personal Financials

- SBA Form 413: The Personal Financial Statement. This must be completed by every owner with 20% or more equity in the business. It lists all personal assets (real estate, retirement accounts, cash) and liabilities.

- Personal Tax Returns: Federal income tax returns for the previous three years for all guarantors.

Legal and Corporate Documents

- Business Licenses and Registrations: Articles of Incorporation, By-Laws, or LLC Operating Agreements.

- Lease Agreements: Copies of current and proposed lease agreements for business premises.

- Franchise Agreements: If applicable, you must provide the Franchise Disclosure Document (FDD) and proof that the franchisor is listed on the SBA Franchise Directory.

Application Specifics

- SBA Form 1919: Borrower Information Form.

- Business Plan: Mandatory for startups and highly recommended for established businesses. It should include market analysis, competitive advantages, and financial projections.

- Resumes: Professional resumes for all key management personnel.

Interest Rates and Fees in 2025

The cost of capital is a primary concern for any borrower. SBA 7(a) loan rates are composed of a base rate plus a spread negotiated with the lender.

Understanding the Base Rate

The base rate is tied to market indicators. The most common base rates used are the Prime Rate, the LIBOR base rate (transitioning to SOFR), or the SBA Peg Rate. In the high-interest environment of 2025, the Prime Rate is the figure to watch daily.

Maximum Spreads

The SBA caps the amount a lender can add to the base rate.

- Loans greater than $50,000: Base Rate + Max 2.25% to 2.75% (depending on maturity).

- Loans of $50,000 or less: Base Rate + Max 6.5%.

- Loans of $25,000 or less: Base Rate + Max 6.5%.

For example, if the Prime Rate is 8.5%, and you secure a large loan with a 2.75% spread, your interest rate would be 11.25%. While this may seem high compared to historical lows, it is often significantly lower than merchant cash advances or online term loans.

Guarantee Fees

The SBA charges a guarantee fee that the lender pays but usually passes on to the borrower.

- Loans up to $1 million: The fee is generally 0% for the 2025 fiscal year (subject to specific SBA policy updates).

- Loans over $1 million: Fees range from 3.5% to 3.75% of the guaranteed portion.This fee can be financed into the loan proceeds, meaning you do not have to pay it out of pocket at closing.

Strategies to Get Approved Fast

Time is money. A standard SBA loan can take 60 to 90 days to close. However, by following these strategies, you can reduce that timeline significantly, potentially closing in as little as 30 to 45 days.

1. Choose a PLP Lender

The Preferred Lenders Program (PLP) is the gold standard. PLP lenders have been delegated authority by the SBA to make final credit decisions without sending the file to the SBA for a second review. This cuts weeks off the processing time. Ask your bank specifically: “Are you a PLP lender?”

2. Utilize SBA Express

If you need less than $500,000, consider the SBA Express Loan.

- Speed: The SBA guarantees a response to the lender within 36 hours.

- Trade-off: The guarantee is only 50% (lower than the standard 75-85%), which might make lenders slightly more conservative, and interest rates can be higher.

3. Pre-Flight Your Financials

Work with a CPA to clean up your books before applying. Ensure your tax returns match your internal P&L statements. Any discrepancy will trigger an audit or a pause in underwriting. If you have “add-backs” (personal expenses paid by the business that should be added back to profit), have them clearly documented and justifiable.

4. Address Life Insurance Early

Many SBA loans require the borrower to have a life insurance policy assigned to the lender as collateral. This is often a bottleneck because medical exams take time. If you know you are applying for a loan, apply for term life insurance immediately. The policy amount must typically match the loan amount.

Common Reasons for Rejection (and How to Avoid Them)

Understanding why loans are denied allows you to preemptively solve problems.

Poor Credit History:

While the SBA does not have a hard minimum credit score, most lenders prefer a FICO score of 680 or higher. If your score is lower, work on paying down credit card balances to lower utilization before applying.

Insufficient Cash Flow:

If your tax returns show a loss for the last two years, approval will be difficult. You must provide a strong narrative explaining why the losses occurred (e.g., one-time legal fees, heavy investment in R&D) and show interim financials proving the business is now profitable.

Incomplete Application:

Submitting an application with “TBD” fields or missing schedules is a red flag. It shows a lack of attention to detail. Do not submit the application until every single document on the checklist is present.

High Industry Risk:

Certain industries like restaurants or hospitality are considered higher risk. In these cases, a robust business plan and higher borrower equity injection (15-20%) can mitigate the lender’s concerns.

Alternatives to SBA 7(a) Loans

If the 7(a) requirements are too stringent or the timeline is too slow, consider these viable alternatives available in the 2025 market.

SBA 504 Loans

Best for purchasing major fixed assets like real estate or heavy equipment.

- Structure: 50% from a bank, 40% from a Certified Development Company (CDC), and 10% from the borrower.

- Benefit: Long-term, fixed rates often lower than 7(a) rates.

Business Lines of Credit

Best for short-term working capital needs.

- Flexibility: You only pay interest on what you draw.

- Speed: Approval can happen in days.

Equipment Financing

The equipment itself serves as collateral, meaning you often do not need additional real estate collateral. Approval is generally fast, and tax benefits (Section 179) can be substantial.

The Role of Fintech in 2025 Lending

The landscape of SBA lending has shifted with the entry of Fintech companies. These non-bank lenders use technology to streamline the application process. While they still adhere to SBA guidelines, their user interfaces are often more intuitive, and their document collection portals are automated.

- Pros: Easier application experience, faster initial feedback.

- Cons: Often lack the relationship-banking aspect where a banker can advocate for your “gray area” application.

Conclusion: Taking the Next Step

Securing an SBA 7(a) loan in 2025 requires diligence, organization, and financial transparency. It is a rigorous process, but the reward is stable, low-cost capital that can fuel your business growth for decades.

Do not let the paperwork deter you. The infusion of capital, combined with the favorable terms of the SBA guarantee, provides the leverage necessary to outperform competitors and secure market share. Start by gathering your tax returns today, checking your credit report for errors, and identifying a Preferred Lender in your area.

The future of your business depends on the actions you take today. Capital is available for those who are prepared to claim it.

Frequently Asked Questions (FAQ)

Q: Can I get an SBA 7(a) loan with bad credit?

A: It is difficult but not impossible. If your score is below 650, you will need strong compensating factors, such as high cash flow, significant collateral, or a co-signer with strong credit.

Q: How much down payment is required for an SBA 7(a) loan?

A: For established businesses, 0% down is possible if cash flow and collateral are sufficient. For startups and acquisitions, expect to put down 10%.

Q: Can I use SBA 7(a) funds to buy a house?

A: No, you cannot buy a personal residence. However, you can buy a property that is “mixed-use” (commercial and residential) provided the business occupies at least 51% of the square footage.

Q: Is collateral required for all SBA loans?

A: For loans under $25,000, lenders are not required to take collateral. For loans over $350,000, lenders must collateralize the loan to the maximum extent possible.

Sources:

- U.S. Small Business Administration: SBA 7(a) Loans

- SBA Standard Operating Procedures (SOP): SOP 50 10 7

- Federal Reserve: Prime Rate Information