Introduction: The New Era of SaaS Exits

The landscape for selling a Software as a Service company has shifted dramatically as we move into late 2025 and 2026. We are no longer in the “growth at all costs” era of 2021. Today, strategic acquirers and private equity firms are scrutinizing unit economics, profitability, and, most critically, your Artificial Intelligence integration strategy. If you are a founder looking to exit, understanding the legal and financial intricacies of a modern M&A deal is not just recommended; it is essential for survival. This guide serves as a comprehensive legal checklist for selling your SaaS business, designed to help you navigate the complex due diligence process, maximize your valuation multiple, and secure a favorable definitive agreement. We will explore high value topics ranging from intellectual property audits to tax optimization strategies that professional wealth managers and M&A attorneys are currently prioritizing.

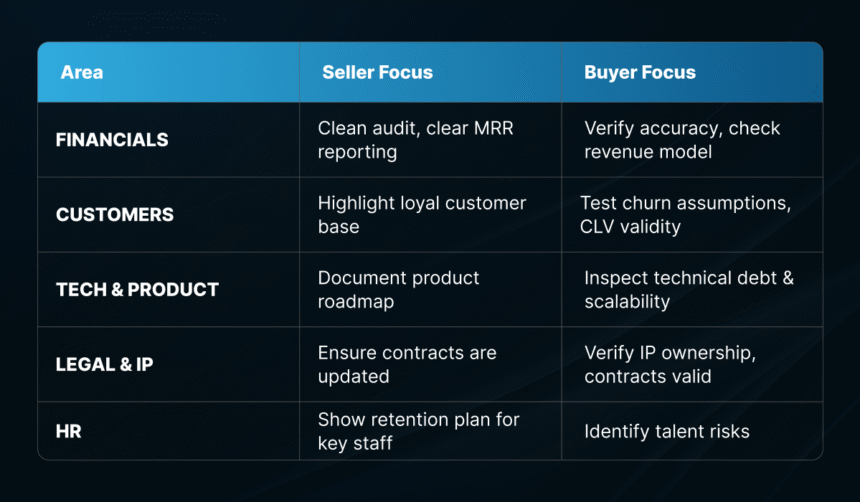

1. Financial Due Diligence and Valuation Readiness

Before you even engage a mergers and acquisitions lawyer or an investment banker, your financial house must be in impeccable order. In 2025, buyers are prioritizing the “Rule of 40” (growth rate plus profit margin) more than ever.

Understanding Your Valuation Metrics

Valuations in the current market have stabilized around 6x to 8x ARR (Annual Recurring Revenue) for healthy private SaaS companies, though premium assets with strong AI defensibility can command significantly higher multiples. You must be prepared to present granular data. This includes Monthly Recurring Revenue (MRR) waterfalls, detailed churn analysis (both logo churn and revenue churn), and Customer Acquisition Cost (CAC) relative to Customer Lifetime Value (LTV).

The Quality of Earnings (QofE) Report

Sophisticated buyers will demand a Quality of Earnings report. This is where you prove that your revenue is real, recurring, and sustainable. You should consider hiring a financial advisory firm to conduct a sell side QofE before going to market. This proactive step can uncover issues with revenue recognition (ASC 606 compliance) that might otherwise derail a deal during the buyer’s due diligence. Ensure your bookkeeping software is fully reconciled and that you have separated one time professional services revenue from true recurring subscription revenue, as the latter commands a much higher valuation multiple.

2. Intellectual Property (IP) Rights and Protection

For a SaaS company, your code is your crown jewel. However, in 2025, the rise of generative AI has introduced complex new legal risks regarding code ownership and copyright.

Open Source Compliance and Black Duck Scans

Buyers will almost certainly employ tools like Black Duck or Synopsys to scan your codebase for open source vulnerabilities. You must ensure that you are not using “copyleft” licenses (like GPL) in a way that requires you to open source your entire proprietary platform. If you discover such issues now, you can remediate them before a buyer finds them and uses them to negotiate a lower price.

AI Generated Code and Copyright

A massive trend in 2025 M&A is the scrutiny of AI generated content. If your developers have used tools like GitHub Copilot or ChatGPT to write core functionality, does your company truly own that IP? Recent legal precedents suggest that purely AI generated works may not be copyrightable. You need to work with an intellectual property attorney to document the “human authorship” involved in your software development process. This documentation will be critical when making representations and warranties in the eventual Stock Purchase Agreement (SPA).

Trademark and Patent Portfolios

Ensure all your trademarks are registered in every jurisdiction where you do significant business. If you have pending patents, ensure all maintenance fees are paid. An IP audit conducted by a specialized law firm can add significant value to your asking price by validating the exclusivity and defensibility of your technology stack.

3. Corporate Structure and Tax Optimization

The structure of your sale (Asset Sale vs. Stock Sale) has massive tax implications. In 2025, tax laws regarding capital gains and business asset disposal are evolving, making early tax planning mandatory.

Qualified Small Business Stock (QSBS)

For founders in the United States, Section 1202 of the Internal Revenue Code remains the “golden ticket” of tax exemptions. If your company qualifies as a Qualified Small Business, you could potentially exclude up to $10 million (or 10x your basis) of capital gains from federal taxes. However, strict holding periods and asset requirements apply. Consult a tax attorney immediately to verify your QSBS eligibility status before signing a Letter of Intent (LOI).

State and Local Tax (SALT) Nexus

With remote work now the standard, your SaaS company likely has employees and customers in dozens of jurisdictions. This creates “nexus,” meaning you may owe sales tax or income tax in those states. Buyers will perform a SALT audit to estimate unpaid tax liabilities. If you have not been collecting sales tax in states where your software is taxable, this liability will be deducted from your closing proceeds. Voluntary Disclosure Agreements (VDAs) can be a tool to mitigate these penalties before a buyer gets involved.

4. Data Privacy and Regulatory Compliance

Data privacy is no longer just a European concern. With the expansion of state level privacy laws in the US (like CPRA in California) and updated AI regulations globally, non compliance is a deal killer.

GDPR and CCPA/CPRA Compliance

You must demonstrate that you have robust data processing agreements (DPAs) in place with all customers and sub processors. Buyers will look for your Record of Processing Activities (ROPA) and evidence of how you handle Data Subject Access Requests (DSARs). If your SaaS platform uses AI to process personal data, you face an even higher bar of scrutiny regarding algorithmic bias and transparency.

AI Governance and Ethics

In 2025, acquirers are terrified of purchasing “toxic” AI models trained on stolen or biased data. You need a clear data lineage policy that traces the origin of all training datasets. If you scraped data from the web to train your models, be prepared for intense legal questioning regarding terms of service violations and copyright infringement. A specialized data privacy lawyer can help you build a “clean room” defense to prove your models are legally compliant.

5. Contracts and Key Stakeholder Agreements

The strength of your recurring revenue is tied to the enforceability of your customer contracts.

Change of Control Provisions

Review every single customer contract, vendor agreement, and partner partnership for “change of control” clauses. These clauses might allow a customer to terminate their contract or renegotiate terms if your company is sold. In a worst case scenario, a major customer could hold the deal hostage. You want to identify these risks early so your legal team can prepare a strategy for obtaining necessary consents.

Assignment Clauses

Similarly, ensure that your contracts are assignable. If you are doing an asset sale, you will need to assign contracts to the new owner. If the contracts are silent on assignment or explicitly forbid it without consent, you face a logistical nightmare.

Employee and Contractor Agreements

Every person who has ever written a line of code for your company must have signed a Proprietary Information and Inventions Assignment Agreement (PIIAA). This legal document ensures that the company, not the individual, owns the IP. Missing PIIAAs are one of the most common reasons for delayed closings. You should also review non compete and non solicitation agreements, keeping in mind that the enforceability of non competes has been significantly weakened by regulators in recent years. Focus instead on robust confidentiality and trade secret protections.

6. The Virtual Data Room (VDR)

The VDR is the venue where the deal actually happens. It is a secure online repository where you will upload thousands of documents for the buyer’s review.

Organizing Your Data Room

A chaotic data room signals a chaotic business. Use a top tier Virtual Data Room provider (like Datasite, VDRPro, or SecureDocs) to organize your files into clear folders: Corporate, Financial, Legal, IP, HR, Sales/Marketing, and Technical. Advanced VDR software allows you to redact sensitive information (like customer names in early stages) and track exactly which documents the buyer is viewing. This tracking data can give you leverage; if a buyer spends 10 hours looking at your churn data, you know that is their primary concern.

7. Navigating the Deal Process: From LOI to Closing

The Letter of Intent (LOI)

The LOI sets the stage. While mostly non binding, the “exclusivity” (or “no shop”) clause is binding and will prevent you from talking to other buyers for 30 to 60 days. Ensure your M&A advisor negotiates a tight exclusivity period to keep the pressure on the buyer. You should also fight for clarity on the working capital adjustment and the definition of “indebtedness” at this stage to avoid surprises later.

Representations and Warranties

The definitive agreement will contain pages of “reps and warranties”—statements of fact that you make about the business. If these turn out to be false, the buyer can sue you for damages. In 2025, “Reps and Warranties Insurance” (RWI) has become standard for deals over $10 million. This insurance policy protects the seller from post closing liabilities, allowing you to walk away with more cash at closing and less money held in escrow.

Indemnification and Escrow

Even with insurance, buyers will demand an escrow account (usually 10% of the purchase price) to be held for 12 to 24 months. This money is used to pay for any undisclosed liabilities that pop up after the deal. Your goal is to minimize the size and duration of this escrow.

Conclusion: Preparation is the Ultimate Leverage

Selling a SaaS company in the competitive 2025-2026 market requires more than just a great product; it requires a legally fortified business. By addressing these items proactively—auditing your IP, optimizing your tax structure, organizing your financials, and securing your data compliance—you shift the leverage in your favor. You move from a position of defensiveness to a position of strength, forcing buyers to compete for a premium asset rather than picking apart a distressed one. Start this process today by consulting with qualified legal and financial professionals. The time you invest in due diligence preparation now will pay dividends in your final exit valuation.

Sources