Scaling a business is a double-edged sword. You have achieved the sales figures that startups dream about, yet you likely face a new, silent profit killer. It is the cost of accepting payments. When you process $5,000 a month, a flat 2.9% fee is manageable. When you process $500,000 or $5 million a month, that same fee becomes a massive hemorrhage on your bottom line.

- The Mathematics of Scale: Why Flat Rate Fails You

- Top Merchant Services for High-Volume Businesses

- Comparison Table: 2024/2025 Market Snapshot

- Critical Features for the Enterprise Merchant

- The Future of Payments: Trends for 2025

- How to Switch Providers Without Downtime

- Conclusion: The Verdict for High-Volume Growth

This guide is for the high-volume merchant. You are no longer looking for the easiest sign-up process; you are looking for the lowest effective rate, the highest approval reliability, and sophisticated fraud defense. We will dissect the current landscape of merchant services for late 2024 and heading into 2025. We will strip away the marketing jargon to expose the actual costs and technical capabilities of the top providers.

The Mathematics of Scale: Why Flat Rate Fails You

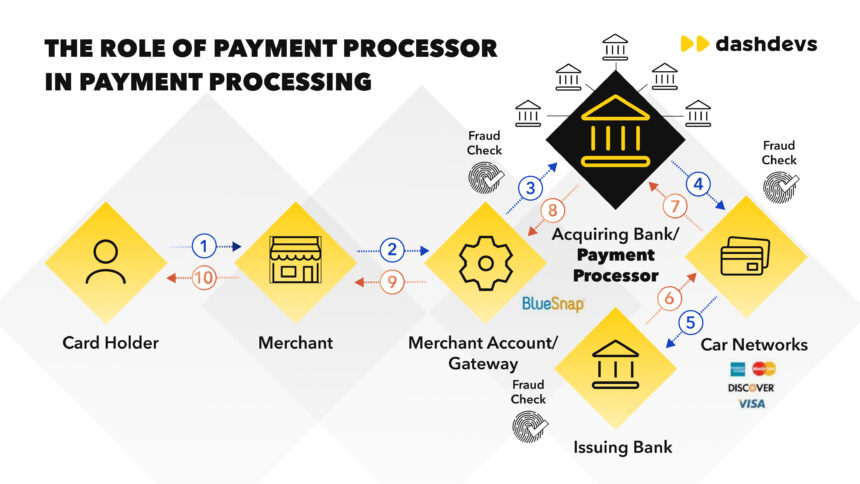

Before we evaluate specific partners, you must understand the pricing dynamics of the industry. Most small businesses start with “Payment Service Providers” (PSPs) like Square or standard Stripe accounts. These use a Flat Rate model.

The Flat Rate Trap:

If you pay a static 2.9% plus 30 cents per transaction, you are overpaying on almost every debit card swipe. The actual cost (interchange fee) of a regulated debit card transaction in the United States might be as low as 0.05% plus 21 cents. The processor keeps the massive spread between their cost and your 2.9% rate.

The Solution: Interchange-Plus Pricing:

High-volume stores must transition to Interchange-Plus (also known as Cost-Plus) pricing. In this model, the processor passes the wholesale interchange rates directly to you and adds a small, transparent markup (e.g., 0.10% or 10 basis points).

- Wholesale Cost (Interchange): Paid to the card issuing bank (Visa/Mastercard).

- Processor Markup: The only fee you can negotiate.

- Assessment Fees: Tiny fees paid to the card brands.

If you process over $25,000 monthly, staying on a flat-rate plan is a financial error. The reviews below prioritize providers who offer transparent, volume-friendly pricing structures.

Top Merchant Services for High-Volume Businesses

We have analyzed these providers based on four critical vectors: Effective Rate, API Flexibility, Payout Speed, and Risk Tolerance.

1. Stax by Fattmerchant

Best For: High-volume US businesses seeking maximum savings.

Stax has disrupted the industry by removing the percentage markup entirely. Instead of charging Interchange + 0.15%, they charge Interchange + 0%. You pay a monthly subscription fee instead.

The Financial Logic:

Imagine you process $100,000 a month.

- Competitor A (Interchange + 0.20%): You pay roughly $200 in markup fees alone.

- Stax (Subscription): You pay a flat subscription (approx. $99 to $199 depending on the plan) and zero markup on the volume.

Pros:

- Zero Markup: You access direct wholesale rates.

- Dashboard Analytics: The Stax platform offers incredible visibility into your “effective rate” (total fees divided by total volume).

- Omnichannel: Seamlessly integrates card-present (terminals) and card-not-present (eCommerce) streams.

Cons:

- Monthly Fee: It is expensive for low-volume months. If you have a seasonal business with months of zero revenue, you still pay the subscription.

- Geographic Limit: Primarily focused on US merchants.

Live Market Data:

As of late 2024, Stax remains the mathematical winner for businesses processing over $40,000 per month. Their “Level 2 Processing” automation is a standout feature for B2B merchants, automatically attaching invoice data to transactions to lower interchange rates on corporate cards.

Source: Stax Official Pricing

2. Helcim

Best For: Transparency and volume-based discounts without contracts.

Helcim is the antithesis of the “shady merchant processor.” They publish their interchange-plus rates openly. Their defining feature is the Tiered Margin System. As your volume goes up, their markup goes down automatically. You do not need to call and negotiate.

Pricing Structure:

- Volume: $0 – $25,000 | Margin: Approx. 0.40% + 8 cents

- Volume: $100,001 – $250,000 | Margin: Approx. 0.20% + 6 cents

- Volume: $5,000,000+ | Margin: Custom Enterprise Rates

Pros:

- No Monthly Fee: Unlike Stax, you do not pay if you do not sell.

- Legacy Legacy Compatibility: Excellent integration with older POS systems and new cloud setups.

- Proprietary Gateway: They own their entire tech stack, meaning fewer “middleman” fees.

Cons:

- Approval Process: They are conservative. They vet merchants thoroughly, so approval is not instant like Stripe.

- Hardware: Limited proprietary hardware options compared to Square, though they support third-party equipment.

Technical Insight:

Helcim includes a virtual terminal and card vaulting (tokenization) for free. For businesses that take orders over the phone or manage recurring billing, this eliminates the need for a separate gateway fee (saving you $20-$30/month typically charged by Authorize.net).

Source: Helcim Pricing Tiers

3. Adyen

Best For: Global Enterprise and Unified Commerce.

If you are Uber, Spotify, or eBay, you use Adyen. Adyen is an acquirer and a processor in one. They connect directly to card schemes (Visa/Mastercard) without third-party banking layers. This reduces failure rates and increases authorization speeds.

Key Advantage: Global Reach

Adyen supports hundreds of local payment methods. If you are scaling into Brazil, you need Pix. If you are scaling into the Netherlands, you need iDEAL. Adyen handles this through a single API.

Pricing Model:

Adyen utilizes an Interchange++ model.

- First Plus: The Acquirer fee.

- Second Plus: The Scheme fee.

- Processing Fee: A tiny fixed fee per transaction (e.g., $0.12 in North America) plus a variable percentage that decreases with volume.

Pros:

- Revenue Protect: Their built-in risk engine is widely considered the best in the industry for preventing fraud without blocking legitimate customers.

- Authorization Rates: Because they are the acquiring bank, they can often recover failed transactions that other processors would lose.

Cons:

- Minimum Volume: Adyen is not for small players. They generally look for merchants processing millions annually.

- Complexity: The integration requires a dedicated development team.

Source: Adyen Global Pricing

4. Chase Payment Solutions (formerly Chase Paymentech)

Best For: Direct banking integration and same-day funding.

For merchants who want the stability of a massive bank, Chase is the leader. As the number one merchant acquirer in the US, they process half of all eCommerce globally.

The “Chase” Advantage:

If you bank with Chase Business Checking, you get Same-Day Funding. You do not wait 2 business days for your cash. The money is in your account the night you batch out.

Pricing:

They offer custom interchange-plus pricing for high-volume accounts. Do not sign up for their generic “QuickAccept” product if you are high volume. Call their sales team to negotiate a custom “cost-plus” contract.

Pros:

- Liquidity: Fastest access to cash in the industry.

- Reliability: Direct connection to the Chase network means virtually zero downtime.

- Negotiation Power: If you have high volume, Chase has the most room to lower your rates to win your banking business.

Cons:

- Legacy Interfaces: Their backend reporting tools can feel dated compared to Stripe or Stax.

- Contract Terms: Be careful. Unlike Helcim, Chase may try to lock you into a longer-term contract with early termination fees unless you negotiate them out.

Source: Chase Business Payment Solutions

Comparison Table: 2024/2025 Market Snapshot

| Feature | Stax | Helcim | Adyen | Stripe |

| Pricing Model | Subscription + Interchange | Interchange + Volume Margin | Interchange++ | Flat Rate (Custom at scale) |

| Monthly Fee | $99+ | $0 | Varies | $0 |

| Ideal Volume | $25k – $5M / month | $5k – $500k / month | $10M+ / year | Developer Driven |

| Tech Focus | Savings & Analytics | Transparency & Retail | Global Scale | API & Software |

| Payout Speed | Next Day | 2 Days | Varies by Region | 2 Days (Instant for fee) |

Critical Features for the Enterprise Merchant

When your transaction volume is high, features that seemed irrelevant at $5k/month become vital operational necessities.

Level 2 and Level 3 Processing

This is the single most overlooked secret in B2B payments.

Visa and Mastercard offer lower interchange rates for transactions that include extra data points (like tax ID, line item details, and invoice numbers).

- Level 1: Standard consumer transaction (Highest Fee).

- Level 3: Full corporate data transfer (Lowest Fee).

The Impact:

Level 3 data can lower your interchange rate by up to 1.00%. On $1 million in monthly B2B volume, that is $10,000 in pure profit saved every month.

Providers like Stax and Helcim have automated tools that attach this data for you in the background. If you sell B2B and your processor does not support Level 3 auto-fill, you are burning cash.

Intelligent Fraud Protection (The AI Shift)

In 2025, fraud is automated. Bots test thousands of stolen cards on your checkout page in seconds (Card Testing Attacks).

You need a processor that uses machine learning to fingerprint devices.

- Stripe Radar: Uses data from millions of businesses to predict if a card is stolen before the bank even declines it.

- Adyen RevenueProtect: Allows you to set custom risk rules. For example, “Block any transaction from an IP address in X country if the shipping address is in Y country.”

High-volume merchants are liable for chargebacks. If your chargeback rate exceeds 1% of your transaction count, Visa will place you in a monitoring program (VDMP), costing you thousands in fines. Your processor must be your shield.

Multi-Currency Settlement

If you are high volume, you are likely international.

Accepting payment in Euros is easy; settling it is hard. Most processors convert the Euros to Dollars and charge you a 1% or 2% conversion fee.

Top-tier processors allow Like-for-Like Settlement. You accept Euros, hold them in a digital wallet, and pay your European suppliers in Euros. You never convert the currency, saving 2% on every international dollar.

The Future of Payments: Trends for 2025

The landscape is shifting rapidly. Here is what is changing right now in the payment ecosystem.

1. Real-Time Payments (RTP) and FedNow

The era of the “3-day settlement” is ending. The US Federal Reserve’s FedNow system is slowly being adopted. In 2025, we expect top merchant providers to offer instant liquidity. This means you process a sale at 10 AM and have the funds available to pay payroll by 2 PM. Chase and specialized B2B processors are leading this charge.

2. Network Tokens

Card numbers expire. When a customer’s card is reissued, your recurring subscription fails.

Network Tokens are the solution. The card networks issue a unique token to your processor that never expires, even if the physical card number changes.

Benefit: This increases authorization rates by roughly 3% to 5%. For a business doing $10 million a year, that is $500,000 in recovered revenue.

3. Embedded Finance

Vertical SaaS is taking over. If you run a salon, you use salon management software. In the past, you would integrate a separate payment terminal. Now, the software is the payment processor.

Expect to see “Payment Infrastructure as a Service” (like Stripe Connect or Finix) become more dominant, where software platforms offer their own branded payments.

How to Switch Providers Without Downtime

Migrating 100,000 customer credit card records is terrifying. Here is the protocol to ensure zero data loss.

- Request “Data Portability” First: Before you sign with a new provider, ensure your current contract allows you to export your tokenized card data. Some bad actors hold your data hostage.

- The PCI Transfer: You cannot email a CSV of credit card numbers. Your new provider (e.g., Stax) will initiate a secure PCI-compliant transfer with your old provider. They exchange encryption keys and move the data server-to-server.

- Gateway Emulation: If you have a hard-coded integration, look for a processor that offers “Gateway Emulation.” This allows the new processor to mimic the API language of the old one (like Authorize.net emulation), so you do not have to rewrite your checkout code.

- A/B Testing: Do not switch 100% of traffic on day one. Route 10% of your transactions to the new processor. Monitor for “False Declines.” If the approval rate is stable, ramp up to 50%, then 100%.

Conclusion: The Verdict for High-Volume Growth

The “best” processor depends entirely on your business DNA.

- If you are a SaaS company needing developer tools and global tax compliance: Stripe is the standard, but negotiate your rate.

- If you are a high-volume US retailer or B2B seller tired of percentage fees: Stax is the mathematical winner.

- If you are a complex global enterprise dealing with cross-border fragmentation: Adyen is the robust solution.

- If you value transparency and no contracts: Helcim remains the most merchant-friendly partner.

Do not let inertia cost you money. Audit your statements today. If you see a generic “Service Fee” or “Non-Qualified Rate,” you are funding your processor’s vacation home. Switch to Interchange-Plus, demand Level 3 processing, and secure your margins.