Today’s Market Pulse: November 25, 2025

An at-a-glance update on the current liability landscape for small business owners.

- Today’s Market Pulse: November 25, 2025

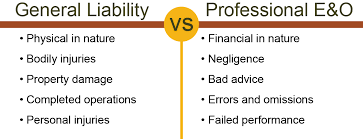

- The Core Dilemma: Physical Damage vs. Financial Loss

- 1. General Liability (GL): The Foundation of Business Protection

- 2. Professional Liability (PL): The Shield for Expertise

- Comparative Analysis: GL vs. PL

- The Emerging Risks of 2025: AI and Cyber Liability

- Industry-Specific Guide: What Does Your Business Need?

- Construction & Trades (Plumbers, Electricians)

- Digital Agencies & Consultants (Marketing, IT, HR)

- Health & Wellness (Yoga Studios, Salons)

- E-Commerce & Retail

- Cost Analysis: What to Expect in Late 2025

- Critical Mistakes to Avoid

- 1. Relying on Personal Insurance

- 2. Underestimating “Defense Costs”

- 3. Ignoring the “Claims-Made” Trigger

- Final Verdict: Which One Do You Need?

Daily Risk Index: HIGH

The legal environment for Limited Liability Companies (LLCs) has shifted dramatically in late 2024 and throughout 2025. We are currently witnessing a phenomenon legal experts call “Social Inflation.” Juries are awarding higher damages than ever before, often driven by public sentiment against businesses.

- Recent Ruling Alert: In early 2025, a Nevada jury returned a staggering $3 billion verdict in a product liability case involving Real Water, highlighting that even consumable product mistakes can lead to company-ending judgments. While this was a large corporation, the precedent trickles down to small business settlements. [Source: Expert Institute]

- Cyber Liability Spike: As of Q3 2025, ransomware attacks targeting small businesses (under 100 employees) have risen by 40%, making digital liability a daily concern for every LLC owner. [Source: DeepStrike Cyber Security]

- Cost Monitor: The average monthly premium for General Liability for low-risk LLCs is holding steady at $42–$50, while Professional Liability rates are seeing slight increases in the tech and consulting sectors due to AI-related risks.

Tip of the Day: Check your policy’s “Cyber Extortion” sub-limit. Many standard policies only cover $10,000 to $25,000, which is often insufficient for modern ransomware demands.

The Core Dilemma: Physical Damage vs. Financial Loss

For any LLC owner, the insurance marketplace can feel like a maze of acronyms and fine print. Yet, the distinction between General Liability (GL) and Professional Liability (PL) is the single most important concept to master.

Think of it this way:

- General Liability pays when you hurt someone’s body or break their stuff.

- Professional Liability pays when you hurt someone’s bank account or reputation.

If you are a contractor dropping a hammer on a client’s foot, that is a General Liability claim. If you are a consultant advising a client to invest in a failing stock, that is a Professional Liability claim. In 2025, where a single lawsuit can bankrupt a small business, understanding this nuance is not just paperwork; it is survival.

1. General Liability (GL): The Foundation of Business Protection

Commercial General Liability (CGL) is often called “slip and fall” insurance, but in 2025, it covers far more than wet floors. It is the baseline requirement for signing most commercial leases and client contracts.

What It Covers

- Bodily Injury: Medical bills, funeral costs, and court-awarded compensation if a non-employee is injured on your premises or by your operations.

- Property Damage: Costs to repair or replace third-party property you accidentally damage.

- Personal and Advertising Injury: This is a hidden gem in GL policies. It covers non-physical offenses like libel, slander, copyright infringement in your advertisements, and wrongful eviction.

Real-World Scenario: The Coffee Shop Incident

Imagine you own a small coffee shop LLC. A customer walks in, trips over a loose cord from your espresso machine, and breaks their wrist. They sue for medical bills and lost wages.

- Without GL: You pay $50,000 out of pocket.

- With GL: Your insurer covers the legal defense and the settlement, minus your deductible.

The 2025 “Nuclear Verdict” Threat

The term “Nuclear Verdict” refers to jury awards exceeding $10 million. While small LLCs rarely hit these numbers, the trend drives up the cost of settlements. Plaintiff attorneys know that juries are angry. Even a minor “slip and fall” case that might have settled for $15,000 five years ago could now command $50,000 or more because insurers fear taking it to trial. This makes carrying adequate GL limits (typically $1 million per occurrence / $2 million aggregate) essential.

2. Professional Liability (PL): The Shield for Expertise

Also known as Errors and Omissions (E&O) insurance, this coverage is critical if you sell your mind rather than your muscle. If your business provides advice, designs, code, or specialized services, you are exposed to professional negligence claims.

What It Covers

- Negligence: Allegations that you failed to meet the standard of care expected in your industry.

- Misrepresentation: Claims that you implied a guarantee or outcome that was not delivered.

- Inaccurate Advice: Consulting errors that cause a client to lose money.

- Copyright Infringement (Service-Related): Unlike GL (which covers ads), PL often covers intellectual property disputes related to the services you deliver, such as a website design that accidentally copies a competitor.

Real-World Scenario: The Software Glitch

You run a boutique IT consulting LLC. You are hired to migrate a client’s database. due to a coding error, the client loses three days of sales data. They sue you for the $100,000 in lost revenue.

- GL Coverage: $0. (Nobody was physically hurt; nothing was physically broken).

- PL Coverage: Covers the cost of the lawsuit and the damages paid to the client.

The “Expectation Gap” in 2025

A major driver of PL claims in 2025 is the “Expectation Gap.” Clients today expect instant results and perfection, often fueled by AI promises. If a marketing consultant promises “10x growth” and only delivers 2x, they can be sued for failure to deliver services. PL insurance pays for your defense even if the lawsuit is frivolous.

Comparative Analysis: GL vs. PL

To make the decision easier, review this direct comparison of risk exposures.

| Feature | General Liability (GL) | Professional Liability (PL / E&O) |

| Primary Trigger | Physical accidents, property damage. | Financial loss, service errors. |

| Key Risk | “I slipped and fell.” | “Your advice cost me money.” |

| Common Claims | Bodily injury, libel, slander. | Negligence, missed deadlines, typos. |

| Who Needs It? | Everyone (Retail, Trades, Offices). | Experts (Consultants, Tech, Medical). |

| Standard Deductible | Often $0 or $500. | Typically $1,000 to $5,000. |

| 2025 Cost Trend | Stable / Low Increase. | Rising for Tech & Finance sectors. |

The Emerging Risks of 2025: AI and Cyber Liability

The line between General and Professional liability is blurring due to technology. Two specific trends are reshaping the insurance needs of LLCs this year.

1. Artificial Intelligence (AI) Liability

If your LLC uses AI tools (like ChatGPT or Midjourney) to create content for clients, who is liable if that content infringes on a copyright?

- Recent Case: Getty Images v. Stability AI has set the stage for massive copyright battles. If you sell an AI-generated logo to a client and it gets flagged for copyright infringement, a standard GL policy might deny the claim. You need a specialized Professional Liability policy with “Media Liability” endorsements to be safe. [Source: Kirkland & Ellis IP Review]

2. Cyber Liability is Not Optional

Standard GL policies explicitly exclude cyber incidents. If you store client credit card data or personal information, and you are hacked, GL pays nothing.

- The Gap: Many LLC owners assume their E&O policy covers data breaches. It often does not unless specifically added. A standalone Cyber Liability policy covers notification costs, ransom payments, and forensic investigations. With 53% of small businesses reporting a cyber attack in the last year, this is a non-negotiable add-on.

Industry-Specific Guide: What Does Your Business Need?

Your industry dictates your risk profile. Here is a breakdown of common LLC types and their insurance necessities.

Construction & Trades (Plumbers, Electricians)

- Must-Have: General Liability. The risk of damaging a client’s home or causing injury is high.

- Maybe: Professional Liability. Required only if you do design work or engineering consulting alongside the physical labor.

- Key Stat: In 2024, property damage claims accounted for over 40% of liability losses in the construction sector.

Digital Agencies & Consultants (Marketing, IT, HR)

- Must-Have: Professional Liability (E&O). Your product is advice. If a campaign flops or software crashes, you are the target.

- Should-Have: General Liability. needed primarily for client contracts and office leases, even if you work remotely. It also covers you if you slander a competitor on social media.

Health & Wellness (Yoga Studios, Salons)

- Must-Have: General Liability. Slip-and-fall risk is high.

- Must-Have: Professional Liability (Malpractice). If a client claims a treatment caused them injury or distress, GL will not cover the “professional service” aspect of the claim.

E-Commerce & Retail

- Must-Have: General Liability. Essential for product liability (if a product hurts someone).

- Must-Have: Cyber Liability. You are a prime target for credit card theft.

Cost Analysis: What to Expect in Late 2025

Budgeting for insurance is a critical part of your LLC’s financial planning. Based on data from major carriers like The Hartford and Next Insurance, here are the current pricing benchmarks.

Average Monthly Premiums (Small LLCs)

- General Liability: $42 to $65 per month.

- Professional Liability: $50 to $90 per month.

- Business Owner’s Policy (BOP): $85 to $130 per month.

How to Lower Your Premiums

- Bundle (The BOP Advantage): Most insurers offer a “Business Owner’s Policy” (BOP) that bundles General Liability with Commercial Property insurance. This can save you 10-15% compared to buying them separately.

- Risk Management Credit: Some carriers offer discounts if you implement safety protocols (e.g., data encryption for IT firms, safety training for contractors).

- Pay Annually: Paying the full premium upfront often eliminates monthly processing fees, saving roughly one month’s worth of premiums per year.

Critical Mistakes to Avoid

1. Relying on Personal Insurance

Your Homeowners or Auto policy will not cover business activities. If you run a daycare out of your home and a child is injured, your home insurance will deny the claim. You need a commercial endorsement or a specific LLC policy.

2. Underestimating “Defense Costs”

In many PL policies, legal defense costs are “inside the limits.” This means if you have a $1 million limit and spend $300,000 on lawyers, you only have $700,000 left for the settlement. In the current litigious environment, ensure your limits are high enough to absorb massive legal fees.

3. Ignoring the “Claims-Made” Trigger

Most Professional Liability policies are “Claims-Made.” You must have the policy active both when the work was done and when the claim is filed. If you cancel your policy today and a client sues you tomorrow for work done last year, you are not covered. Always purchase “Tail Coverage” (Extended Reporting Period) if you switch providers or close your business.

Final Verdict: Which One Do You Need?

For 90% of LLCs, the answer is both.

We live in a world where a client can sue you for a physical accident on Tuesday and a professional error on Wednesday. The separation between “physical” and “financial” harm is the only line that matters to insurance adjusters.

- Get General Liability to keep your doors open, satisfy your landlord, and protect against accidents.

- Get Professional Liability to protect your hard-earned reputation and personal assets from claims of negligence.

Next Steps for Your LLC

Do not wait for a lawsuit to find out you are underinsured.

- Audit your current contracts: Do your clients require specific limits you don’t have?

- Check your NAICS code: Ensure your insurer has classified your business correctly; a misclassification can lead to a denied claim.

- Request a “Certificate of Insurance” (COI): Have this ready digitally. It makes you look professional and wins more bids.

Would you like me to help you draft a checklist of questions to ask your insurance broker to ensure you are getting the best 2025 rates?

Sources & Further Reading

- General Liability Costs & Trends: The Hartford – General Liability Cost Data

- Professional Liability & Lawsuit Examples: Insureon – Professional Liability Claims

- 2025 Legal Landscape & Nuclear Verdicts: Allianz Commercial – Liability Claims Trends

- Cyber Risks for SMBs: DeepStrike – Cyber Attacks on Small Businesses 2025

- Legal Case References: Saxe Doernberger & Vita, P.C. – Top Insurance Cases