The economic landscape of 2025 has introduced a dynamic shift in how the Australian government supports the private sector. For small to medium enterprises (SMEs), free capital is no longer just a safety net; it is a strategic accelerant for innovation, export expansion, and digital transformation.

- The 2025 Grant Landscape: What Has Changed?

- Top Federal Grant Programs for 2025

- 1. Export Market Development Grants (EMDG) – Round 4

- 2. The Research and Development (R&D) Tax Incentive

- 3. CSIRO Kick-Start

- State-Specific Opportunities (2025 Highlights)

- New South Wales (NSW): MVP Ventures Program

- Victoria: Business Competitiveness Program

- Queensland: Business Growth Fund Program

- South Australia: Powering Business Grants

- Strategic Niche Grants

- Eligibility Checklist: Are You Grant-Ready?

- The Application Process: Step-by-Step

- Phase 1: The Documentation Audit

- Phase 2: The Project Narrative

- Phase 3: The Budget

- Phase 4: Submission and Tracking

- Common Reasons for Rejection

- Alternatives to Grants

- Conclusion

If you are a business owner operating in 2025, understanding the grant ecosystem is arguably as important as your profit and loss statement. This guide provides a comprehensive, deep-dive analysis into the current eligibility criteria, trending grant programs, and the precise application mechanics you need to master to secure funding this fiscal year.

The 2025 Grant Landscape: What Has Changed?

The philosophy behind government funding has evolved. In previous years, grants were often broad stimulus packages. In 2025, the focus is highly targeted. Federal and State governments are prioritizing three specific pillars: Sustainability, Innovation, and Global Trade.

Agencies are looking for businesses that can demonstrate a return on investment (ROI) not just for themselves, but for the Australian economy. This means your application must speak the language of job creation, carbon reduction, and technological advancement.

The “SmartyGrants” Dominance

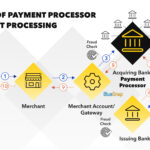

Almost all federal and state applications in 2025 are processed through portals like SmartyGrants. This digitization means that compliance checks are automated. If your Australian Business Number (ABN) details do not match your application exactly, or if your tax filings are not up to date with the ATO, you will be rejected by an algorithm before a human ever reads your proposal.

Top Federal Grant Programs for 2025

These are the “heavy hitters” of the Australian grant world. They are typically non-competitive entitlements or high-value competitive rounds designed for established businesses looking to scale.

1. Export Market Development Grants (EMDG) – Round 4

The EMDG program remains the flagship initiative for Australian exporters. For the 2025-26 and 2026-27 financial years, the program has solidified its transition from a reimbursement scheme to a grant agreement model.

What this means for you:

You now know how much funding you have secured before you spend the money. This provides significantly better cash flow certainty for businesses planning international marketing campaigns.

Funding Tiers:

- Tier 1 (Ready to Export): Up to $30,000 per financial year. Designed for first-time exporters.

- Tier 2 (Exporting within Existing Markets): Up to $50,000 per financial year.

- Tier 3 (Exporting to New Markets): Up to $80,000 per financial year.

Eligibility Criteria:

- Turnover of less than $20 million.

- Must be the principal owner of the goods/services (not an agent).

- Critical Requirement: You must have a high-quality “Plan to Market.” This document is scrutinized heavily. It must outline your budget for promotional activities, travel, and trade fairs.

- Compliance: You must be tax compliant. Any outstanding debts to the ATO can disqualify your application immediately.

2. The Research and Development (R&D) Tax Incentive

While technically a tax offset, this is effectively the largest source of government funding for Australian businesses. It is uncapped and non-competitive.

The 2025 Rates:

- Turnover < $20 million: You can claim a refundable tax offset of your corporate tax rate plus an 18.5% premium (totaling up to 43.5% or 48.5% depending on your base rate). This is cash back in your pocket if you are in a tax loss position.

- Turnover > $20 million: A non-refundable tax offset to reduce tax payable.

What Qualifies as R&D?

Many businesses undervalue their activities. You do not need a laboratory to qualify.

- Core Activities: Experimental activities whose outcome cannot be known in advance and are conducted for the purpose of generating new knowledge.

- Supporting Activities: Activities directly related to the core R&D (e.g., software testing, engineering trials, production runs for testing).

Application Insight:

Registration must be lodged with AusIndustry within 10 months of the end of your company’s income year. For a standard financial year ending 30 June 2025, your deadline is 30 April 2026. However, smart businesses prepare their documentation monthly using specialized accounting software to track R&D hours and expenses.

3. CSIRO Kick-Start

For startups and SMEs with a turnover under $1.5 million, the CSIRO Kick-Start program provides matched funding between **$10,000 and $50,000**.

Purpose:

To help you pay for CSIRO’s research expertise. If you have a product idea but lack the technical engineering or scientific validation to build a prototype, this grant pays for CSIRO scientists to do the work for you.

Application Tip:

This is open year-round but highly competitive. Success depends on the commercial viability of the idea. You must demonstrate that after the research is complete, you have a business plan to monetize the result.

State-Specific Opportunities (2025 Highlights)

State governments often move faster than the Federal government, offering “flash” grants that open and close within weeks.

New South Wales (NSW): MVP Ventures Program

The Minimum Viable Product (MVP) grants in NSW are legendary for early-stage tech companies.

- Offer: Matched funding up to $200,000 (amounts vary by specific round guidelines) to help commercialize innovative products.

- Requirement: You generally need to be pre-revenue or early revenue and must demonstrate that 80% of development costs will occur in NSW.

Victoria: Business Competitiveness Program

Victoria continues to focus heavily on manufacturing.

- Focus: Helping manufacturers upgrade machinery and digital capability.

- Funding: Grants often range from $50,000 to $500,000 but require a significant co-contribution (usually 3:1 or 2:1).

- Tip: Quotes for new machinery must be sourced from reputable suppliers. Financing the co-contribution portion through business loans is a common strategy for applicants.

Queensland: Business Growth Fund Program

Queensland’s 2025 strategy targets high-growth SMEs.

- Offer: Up to $50,000 for purchasing specialized equipment.

- Eligibility: You must demonstrate a history of growth and a clear path to hiring more staff. This is not for struggling businesses; it is for businesses ready to explode.

South Australia: Powering Business Grants

As energy costs rise, SA has rolled out substantial support for energy efficiency.

- Offer: Grants between $2,500 and $75,000.

- Usage: Implementing battery storage, solar upgrades, or replacing old equipment with energy-efficient alternatives.

- Dates: Rounds typically open in August and close in October (or when funds are exhausted).

Strategic Niche Grants

Specialized funding pools often have higher success rates because the pool of applicants is smaller.

Women in Business

The Investing in Women Funding Program and various state-based initiatives (like the NSW “Supporting Women in Business” grants) are active in 2025.

- Focus: These grants often target female founders in male-dominated industries (STEM, construction, finance).

- SPARK Biz Grants: Private/community initiatives like SPARK are offering smaller, rapid-access cash injections ($5k – $10k) which are excellent for micro-business marketing or equipment needs.

Indigenous Business Funding

The Indigenous Advancement Strategy (IAS) and the Future Industries Grant Program are critical pillars.

- Future Industries: Grants capped at $50,000 for feasibility studies in sectors like renewable energy, carbon farming, and aquaculture.

- Start-Up Grants (NT): Northern Territory offers up to $100,000 for Indigenous start-ups, covering working capital, wages, and plant equipment.

Green Energy and Sustainability

This is the highest-trending category in 2025.

- Energy Efficient Communities Program: Provides small grants (often $10k-$25k) for businesses to audit their energy use and install monitoring systems.

- Solar for Business Rebates: While some direct rebates are phasing out, they are being replaced by “green loans” or interest-free financing backed by state governments to install solar battery systems.

Eligibility Checklist: Are You Grant-Ready?

Before you write a single word of an application, you must pass the “compliance gate.” In 2025, if you fail these checks, your application is archived immediately.

- Business Structure: You must have an active ABN. Most high-value grants require you to be a Company (Pty Ltd), not a Sole Trader or Partnership. If you are currently a Sole Trader, consult with a business accountant about restructuring before applying.

- GST Registration: You must be registered for GST. This signals to the government that you are an active, trading entity.

- Financial Solvency: You cannot be insolvent or under external administration.

- Insurance: Most government contracts and grants require you to hold valid Public Liability Insurance (usually minimum $10 million) and Professional Indemnity Insurance. You will be asked to upload Certificates of Currency.

- Location: You must have a physical operating address in Australia. PO Boxes are rarely accepted for site-specific grants.

The Application Process: Step-by-Step

Writing a grant is a blend of technical writing and sales copywriting. Here is the workflow of a successful applicant.

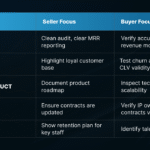

Phase 1: The Documentation Audit

Gather these documents and store them in a cloud drive folder named “Grant Master File 2025”.

- Financial Statements: Profit & Loss and Balance Sheet for the last two financial years.

- Cash Flow Forecast: A 12-month projection showing how the grant money will be spent and how it improves your position.

- Business Plan: An updated document detailing your market analysis, competitor research, and growth strategy.

- Quotes: You generally need two written quotes for any item you intend to buy with grant money. These must be formal quotes from third-party suppliers, not screenshots from a website.

Phase 2: The Project Narrative

You will be asked to describe your project. Do not be vague.

- Bad: “We want to buy a new coffee machine to serve more customers.”

- Good: “We are requesting funding to procure high-volume industrial beverage equipment. This investment will reduce customer wait times by 40%, allowing us to increase daily transaction volume by 25% and hire one additional casual staff member to manage the increased output.”

Keywords matter: Use terms like productivity, scalability, export-readiness, job creation, and innovation.

Phase 3: The Budget

Your budget must balance. If you are applying for a matched grant (50/50 split), you must provide evidence that you have your 50% ready.

- Evidence: A bank statement showing the funds or a letter of offer from a financial institution (business loan pre-approval) is often required to prove you can match the funding.

Phase 4: Submission and Tracking

Submit early. Portals like SmartyGrants often crash at 4:55 PM on the closing date due to traffic. Once submitted, keep a copy of the receipt.

Common Reasons for Rejection

- Ineligible Expenditure: Asking for money to pay for ongoing operational costs (rent, existing staff wages). Grants are usually for new projects, not business-as-usual costs.

- Poor Financials: If your balance sheet shows you are on the brink of bankruptcy, the government will not invest in you. They want to back winners.

- Lack of Co-contribution: Failing to prove you have the funds to match the grant.

- Vague Outcomes: Failing to specify exactly how many jobs will be created or how much revenue will increase.

Alternatives to Grants

Grants are excellent, but they are slow. The assessment process can take 3 to 6 months. If you need capital immediately, you should consider the broader financial market.

- Small Business Loans: Unsecured business loans have faster approval times (often 24-48 hours). While they incur interest, the speed of capital can sometimes outweigh the cost if the ROI on the project is high.

- Invoice Finance: If you have outstanding invoices from other businesses, invoice financing allows you to unlock that cash immediately rather than waiting 30-90 days for payment.

- Equipment Finance: Instead of paying cash for machinery, equipment finance allows you to spread the cost over several years, preserving your working capital.

- Venture Capital / Angel Investment: For high-growth tech startups, equity funding is often more substantial than government grants.

Conclusion

Securing a small business grant in Australia in 2025 requires diligence, preparation, and strategic timing. The money is there, but it flows to those who are organized and compliant.

Do not wait for a grant to open to start preparing your business plan or financial forecasts. Update them today. Ensure your insurance is valid. Check your credit score and financial health. When the portal opens, you want to be the first to apply, not the one scrambling for a quote at the deadline.

Next Steps:

Bookmark the official government grant search engines GrantConnect and business.gov.au. These are your sources of truth. Set a recurring calendar appointment every Monday morning to check for new opportunities.

Key Source Links

- GrantConnect (Federal): https://www.grants.gov.au

- Business.gov.au: https://business.gov.au/grants-and-programs

- Austrade EMDG: https://www.austrade.gov.au/en/how-we-can-help-you/grants/export-market-development-grants

- ATO R&D Tax Incentive: https://www.ato.gov.au/businesses-and-organizations/income-deductions-and-concessions/incentives-and-concessions/research-and-development-tax-incentive

- SmartyGrants: https://smartygrants.com.au