In the unpredictable landscape of modern business, safeguarding your organization’s financial health is paramount. While most business owners diligently insure their physical assets like buildings, inventory, and vehicles, a significant oversight often remains. The most valuable asset of any company is not its machinery or its intellectual property but the people who drive its success. This is where Key Man Insurance (also known as Key Person Insurance) becomes a critical component of a comprehensive risk management strategy.

- What Is Key Man Insurance?

- Who Qualifies as a “Key Man” or “Key Person”?

- Why Your Business Needs Key Person Protection

- How Does Key Man Insurance Work?

- Types of Coverage Available

- Tax Implications: The Critical Details

- Trending Keywords and Market Shifts in 2025

- Step-by-Step Guide to Purchasing a Policy

- Common Exclusions and Pitfalls

- Frequently Asked Questions (FAQ)

- Conclusion: A Pillar of Corporate Resilience

As we navigate the economic volatility of late 2025, with fluctuating markets and global tariff uncertainties, the stability provided by such financial instruments is more relevant than ever. This guide delves deep into the mechanics, benefits, taxation, and strategic importance of Key Man Insurance.

What Is Key Man Insurance?

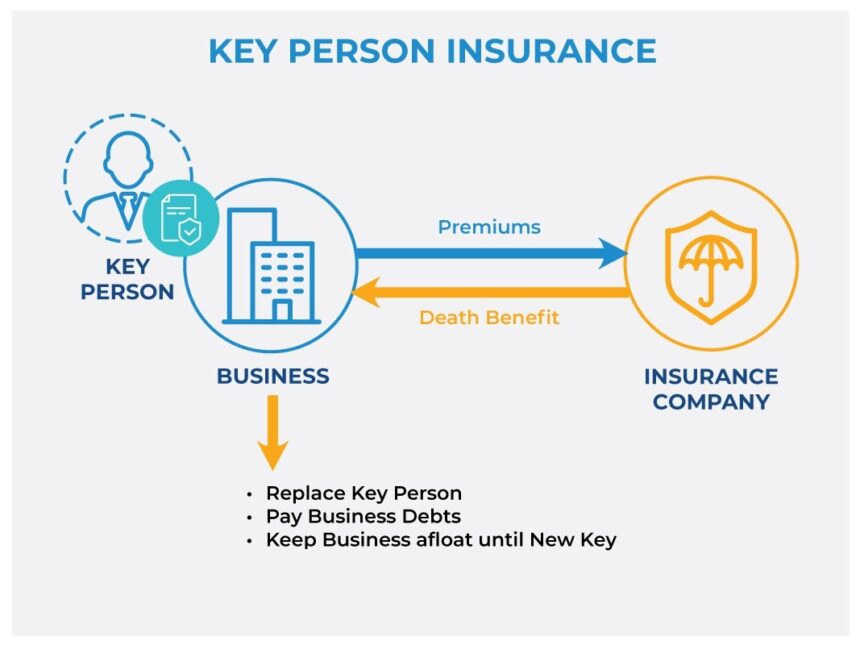

At its core, Key Man Insurance is a life insurance or disability insurance policy purchased by a business on the life of a critical employee. The company acts as the applicant, the policy owner, the premium payer, and the beneficiary. If the insured individual passes away or becomes disabled (depending on the policy type), the insurance company pays a lump sum benefit directly to the business.

This payout is not intended to enrich the business but to serve as a financial buffer. It provides the necessary liquidity to navigate the turbulent period following the loss of a key contributor. The funds can be used to hire a replacement, cover lost revenue, pay off debts, or reassure investors and lenders that the company remains solvent.

Who Qualifies as a “Key Man” or “Key Person”?

A “Key Person” is any employee whose absence would cause a significant financial impact on the company. This definition is broad and varies by industry, but typically includes:

- Founders and Owners: The visionaries whose leadership is synonymous with the company’s brand and direction.

- Top Salespeople: Individuals responsible for generating a substantial portion of the company’s revenue.

- Specialized Technical Talent: Lead engineers, software architects, or researchers with proprietary knowledge that is difficult to replace.

- C-Suite Executives: CEOs, CFOs, or COOs who manage critical day to day operations and hold vital banking or investor relationships.

- Niche Skill Holders: An employee with a unique certification or skill set required for the business to operate legally or effectively.

If you find yourself asking, “How would our business survive if this person did not walk through the door tomorrow?” then you have identified a candidate for Key Person Insurance.

Why Your Business Needs Key Person Protection

The sudden loss of a pivotal team member can trigger a domino effect of negative consequences. Here is how this insurance coverage acts as a firewall against potential disaster:

1. Operational Continuity and Cash Flow

The immediate aftermath of a key employee’s death often involves a dip in productivity and sales. The death benefit provides working capital to keep the lights on, pay remaining staff, and manage overheads while the business restabilizes.

2. Recruitment and Training Costs

Finding a replacement for a high level executive or specialized expert is expensive. Headhunter fees, signing bonuses, and the time cost of training a new hire can be substantial. Insurance proceeds cover these recruitment expenses without draining the company’s reserves.

3. Protecting Credit and Loans

Many banks and commercial lenders require Key Man Insurance as a condition for issuing large business loans. The policy serves as collateral. If the guarantor (the key person) dies, the payout can be used to retire the debt immediately, preventing the lender from calling the loan and putting the business in jeopardy.

4. Facilitating Shareholder Buyouts

In closely held corporations or partnerships, the death of an owner can complicate the ownership structure. Key Person Insurance can be structured to fund a Buy-Sell Agreement, allowing the remaining partners to buy out the deceased partner’s shares from their estate. This ensures the business remains with the existing leadership team rather than passing to uninvolved heirs.

5. Investor Confidence

Venture capitalists and angel investors view Key Man Insurance as a sign of professional maturity and prudent risk management. It reassures them that their investment is protected against “human capital risk.”

How Does Key Man Insurance Work?

The process of securing this coverage is straightforward but requires adherence to specific legal and procedural steps to ensure validity and tax compliance.

Step 1: Identifying the Need and Amount

The business must first quantify the value of the key person. Common valuation methods include:

- Multiple of Salary: Insuring the employee for 5 to 10 times their annual compensation.

- Contribution to Profit: Estimating the percentage of net profit attributable to the individual and multiplying it by the years needed to replace them.

- Replacement Cost: Calculating the total cost to recruit, hire, and train a successor, plus estimated lost revenue during the transition.

Step 2: Obtaining Consent

This is a crucial legal requirement. The business must notify the employee in writing that it intends to purchase a policy on their life and specify the maximum face amount. The employee must provide written consent to be insured and acknowledge that the business will be the beneficiary. Failure to do this can have severe tax consequences (discussed below).

Step 3: Underwriting

The insurance carrier will evaluate the risk. This involves a medical exam for the employee and a review of the company’s financial health. In 2025, we are seeing a trend toward AI driven underwriting, which speeds up this process by analyzing data points more efficiently than traditional methods.

Step 4: Policy Issuance

Once approved, the business pays the premiums. Term life insurance is the most common vehicle used due to its affordability and high coverage amounts, but permanent life insurance (like Whole Life or Universal Life) can be used if cash value accumulation is desired.

Types of Coverage Available

While Term Life is the standard, businesses should consider a mix of products to cover different risks:

- Key Person Term Life Insurance: Provides a death benefit for a specific period (e.g., 10, 20 years). It is cost effective and ideal for covering loans or the working years of an executive.

- Key Person Permanent Life Insurance: Offers lifetime coverage and builds cash value that can be recorded as a business asset. It can be used for executive bonus plans or retirement funding if the death benefit is not needed.

- Key Person Disability Insurance: Often overlooked, the risk of a key employee becoming disabled is statistically higher than them dying during their working years. This policy provides cash flow to pay for a temporary replacement or cover the salary of the disabled individual.

- Critical Illness Cover: Pays out a lump sum if the key person suffers a specified illness like a heart attack, stroke, or cancer, allowing the business to manage the disruption.

Tax Implications: The Critical Details

Understanding the tax treatment of Key Man Insurance is vital to ensure you receive the benefits you expect. Note: Tax laws vary by jurisdiction, and this information is general in nature. Always consult a tax professional.

Are Premiums Tax Deductible?

Generally, no. If the business is the beneficiary of the policy, the premium payments are not tax deductible as a business expense. They must be paid with after tax dollars. This is because the death benefit is intended to be tax free.

Are Death Benefits Taxable?

Usually, no. The lump sum payout received by the business is typically free from income tax. However, in the United States, for example, the COLI (Corporate Owned Life Insurance) Best Practices Act mandates that specific Notice and Consent requirements be met before the policy is issued.

- The Rule: If you fail to obtain proper written consent before issuance, the death benefit may be fully taxable as ordinary income to the extent it exceeds the premiums paid.

- The Exception: If the proper notice and consent are filed, and the insured was a director or highly compensated employee, the proceeds remain tax free.

- AMT Considerations: For C Corporations, the death benefit may increase the company’s “Adjusted Current Earnings” (ACE), potentially triggering the Alternative Minimum Tax (AMT).

Trending Keywords and Market Shifts in 2025

The insurance landscape is evolving. When researching or purchasing these policies today, be aware of these trending topics:

- Business Continuity Strategies: Post pandemic resilience has made continuity planning a top priority for boards.

- Startup Risk Management: Investors are increasingly mandating key person clauses in term sheets.

- Executive Wellness Programs: Insurers are offering value added services like health monitoring for insured executives to reduce risk.

- Trauma Insurance: A growing niche covering psychological impact and recovery for key leaders.

- Cyber Insurance Integration: Some carriers are bundling key person risk with cyber liability, recognizing that the loss of a CIO could lead to digital vulnerabilities.

Step-by-Step Guide to Purchasing a Policy

- Assess Your Risk: Conduct a “what if” analysis for your top 5 employees.

- Consult an Independent Broker: Work with a broker who specializes in business insurance (B2B) rather than personal lines. They will have access to carriers with higher limits and specialized underwriting for high net worth individuals.

- Determine Policy Structure: Decide between Term vs. Permanent based on your cash flow and long term goals.

- Prepare Documentation: Have your corporate financials, employee consent forms, and board resolutions ready.

- Review Annually: As your business valuation grows, your coverage amount should increase. A policy bought five years ago may be woefully inadequate for your current revenue levels.

Common Exclusions and Pitfalls

Like all insurance contracts, Key Man policies have exclusions. Common ones include:

- Suicide Clause: Most policies will not pay out if the insured commits suicide within the first two years of the policy.

- Fraud or Misrepresentation: If the business or employee failed to disclose a pre existing condition or lifestyle risk (like skydiving) during the application, the claim could be denied.

- Illegal Acts: Death resulting from the insured participating in illegal activities is typically excluded.

Frequently Asked Questions (FAQ)

Q: Can we transfer the policy to the employee if they leave?

A: Yes, this is a common feature. If a key person retires or leaves, the business can often transfer ownership of the policy to the employee. The employee then takes over premium payments and names their own beneficiaries. This can be a valuable perquisite or part of a severance package.

Q: How much coverage is enough?

A: A common rule of thumb is 5x to 10x the key person’s total compensation, or 1x to 2x the company’s annual net profit. However, for a startup seeking funding, the coverage should match the investment amount sought.

Q: Is Key Man Insurance the same as Shareholder Protection?

A: They are similar but distinct. Key Man Insurance protects the business entity from financial loss. Shareholder Protection provides funds specifically to buy out a deceased shareholder’s equity. Often, businesses need both.

Q: Does the employee pay income tax on the premiums?

A: No. Since the business is the owner and beneficiary, the premiums paid by the company are not considered taxable income for the employee.

Conclusion: A Pillar of Corporate Resilience

Key Man Insurance is not merely a purchase; it is a strategic decision that signals stability to your partners, employees, and investors. It transforms the intangible value of your leadership team into a tangible asset that can save your business in its darkest hour. In an era where human capital is the primary driver of innovation and profit, protecting that capital is the smartest investment a business owner can make.

Don’t wait for a crisis to expose your vulnerabilities. Evaluate your key personnel risks today and secure the future of the enterprise you have worked so hard to build.

Sources & Further Reading:

- Legal & General: Key Person Protection Explained Source

- Policybazaar: Keyman Insurance Benefits and Types Source

- IRS.gov: COLI Best Practices Act & Section 101(j) Source

- ValuePenguin: Key Man Life Insurance Cost & Tax Treatment Source

- Marsh Commercial: Risk Management and Key Person Cover Source

- Earnix: Insurance Industry Trends 2025 Source